•

What Bitcoin’s current risk-reward really is, whether the bull runs or the bear strikes.

Bitcoin is undoubtedly at one of those crossroad moments that make you stop and think: do I stack sats now, or brace for further downside?

The market is signalling two potential paths: a continuation of the bull, or a bear market drawdown. Which will play out? I don’t claim to know. What I do know is how to quantify the risk and spot asymmetric opportunities in either scenario — and that’s exactly what we’re diving into today.

In this article, I’ll share the metrics I track every week and explain exactly how I approach Bitcoin accumulation under both possibilities.

Let’s get into it.

Short-Term Risk Opportunities: Bitcoin is flashing one of the rare short-term buy signals in this cycle, indicating high asymmetric upside potential.

Mean Reversion Floors: Advanced mean-reversion analysis suggests current prices align with historically strong retracement levels.

Long-Term Growth Potential: Logarithmic growth models project a fair value of $327k by 2030, highlighting asymmetric long-term upside.

Strategic Accumulation Mindset: Price volatility at this stage is less critical for long-term investors focused on accumulation.

Two Scenarios, One Approach

Let’s not overcomplicate things: Bitcoin’s immediate path is uncertain, but the key is understanding the probabilities and preparing for both outcomes. Personally, I’m comfortable with either scenario because my strategy focuses on risk management and long-term accumulation rather than predicting the exact market turn.

To make sense of it all, we need to examine both scenarios closely.

Scenario 1: A Continuing Bull Market

If this is simply a bull market dip, we could be looking at some of the best buying opportunities this cycle has offered.

Let’s unpack why this moment is so compelling, starting with one of the most reliable tools that I use every week: the Short-Term Risk Score (STRS). For those unfamiliar, this metric aggregates 9 different on-chain and market signals — everything from volatility and momentum to unrealised profits and short-term holder behaviour — into a single score reflecting short-term market risk.

Historically, the STRS has flagged only 4 golden buying opportunities over the last 3 years, all prior to continued bull runs. Each was marked by a risk score below 30%, highlighted in red on the chart below.

These signals are rare, but when they appear, they provide us with asymmetric short-term opportunities. We’ve just received the 5th such signal. So if the bull trend is continuing, this is exactly where I want to be accumulating.

When the score dips below 30%, it marks an asymmetric opportunity where potential upside far outweighs downside risk. This isn’t a common occurrence, so when it happens, it’s a clear cue to stack Bitcoin more aggressively, as these levels have historically launched the next leg up.

Mean Reversion Opportunities

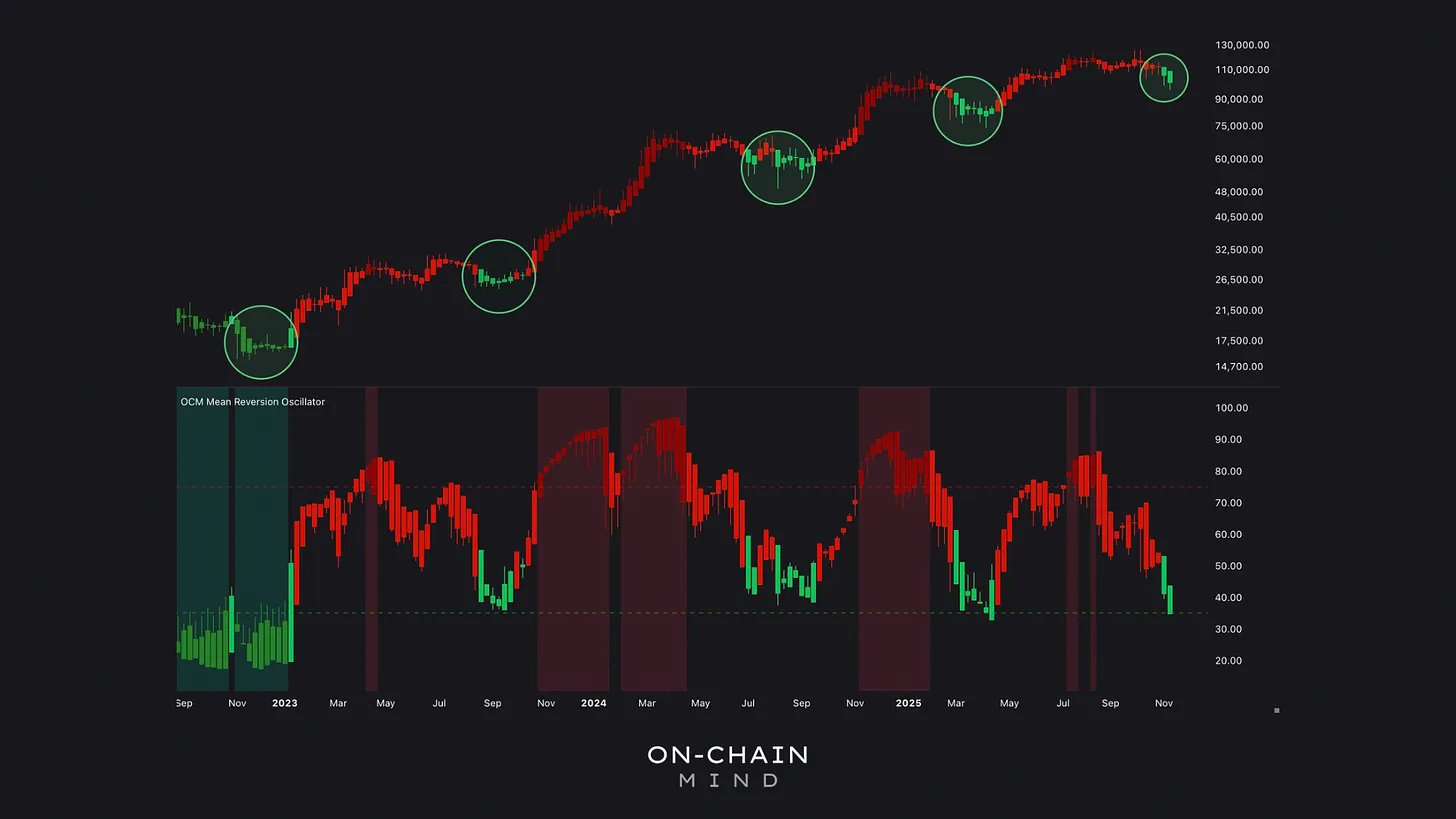

Beyond the STRS, another tool that I monitor very frequently is the Mean Reversion Oscillator, which is an advanced, multi-dimensional version of the traditional RSI. This tool helps identify short-term oversold and overbought conditions with higher fidelity.

The oscillator provides a visual cue through bar encoding and background colours, highlighting bullish and bearish extreme conditions. At present, we’re seeing our first green oversold reading in months, a signal that has historically marked local bottoms in continuing bull markets.

This alignment of signals suggest that if the bull market persists, this is an optimal buying opportunity, providing a high potential reward relative to the short-term risk.

A key level to watch is the green dashed line at 35 on the scale, which has consistently acted as a retracement floor in this bull run. Price is currently hovering right around this zone.

Scenario 2: A Bear Market Drawdown

Now, let’s consider the alternative. What if the bull market thesis is wrong, and we’re on the cusp of a bear market? Is buying at $95,000 a mistake? Not necessarily. Buying at current levels may initially feel uncomfortable if prices decline further. But even then, my models suggest that even in a bearish scenario, downside risk is likely bounded between $70k and $80k — but that’s not the basis of this article.

Let’s zoom out and break this all down using my Logarithmic Growth Model, which is a mathematical framework that applies a logarithmic regression with a dynamic decay factor to map out a long-term “fair value” trajectory for Bitcoin.

As we know, Bitcoin’s price doesn’t grow linearly; it follows a logarithmic curve, reflecting diminishing marginal growth as adoption matures. And by extending this model forward using time-scaled logarithmic calculations, we can project Bitcoin’s price dynamics out to 2030 and beyond.

The model currently estimates a logarithmic fair value of $327,000 by January 2030, a figure that might sound audacious at first but is grounded in historical growth patterns.

The logarithmic growth model is based on a time-scaled logarithmic regression that captures adoption-driven growth and the diminishing marginal returns characteristic of a maturing asset.

Log Risk

To gauge long-term risk, the Logarithmic Growth Oscillator measures Bitcoin’s deviation from the model in a normalised range, highlighting periods of over- or under-valuation relative to this long-term growth trend.

Historically, each Bitcoin cycle has experienced both upside and downside deviations, though these swings have become less extreme as the market matures and adoption deepens. While the fair value line sits around $327,000, it’s important to recognise that prices can and do stretch well above or below this level. In other words, short-term volatility remains a feature, not a bug, of Bitcoin’s price dynamics.

Looking ahead to 2030, this oscillator indicates a lower expected deviation of roughly $155,000. This means that even if the market moves against us in the near-term, accumulating today at $95,000 positions us comfortably above the long-term floor and provides a strong asymmetric risk-reward profile.

While $327,000 represents the model’s 2030 fair value, Bitcoin’s price naturally oscillates above and below this line, creating opportunities for disciplined accumulation along the way.

Unfazed by Volatility

So, what am I actually doing at $95,000? I’m stacking Bitcoin, and I’m doing it with confidence. At these levels, the market is testing our conviction. Whether this is a bull market dip or the early stages of a bear, I remain unfazed. Why? Because I’m in the accumulation stage of my life, and the data supports adding at these levels.

Some are calling this bull cycle “boring”, yet we still saw nearly an 8x return from bottom to top. As Bitcoin matures, volatility will naturally decrease, but the absolute gains remain substantial. So looking ahead, a 3.5x move from $95,000 to $327,000 by 2030 is not only exciting, but it’s entirely plausible.

Both scenarios — a bull continuation or a bear drawdown — are acceptable outcomes. In a bull market, you’re stacking at historically opportune retracement levels. In a bear market, defined floors and long-term models still support substantial upside for the years to come. Either way, you’re positioned on the right side of the risk-reward equation.

Each cycle reinforces the same lesson: these moments are gifts for those focused on the long game. They are opportunities to stack sats at levels that may seem absurdly cheap a few years from now and reminders that Bitcoin’s trajectory is upward, even if the path is bumpy.

Of course, I’m not suggesting anyone blindly buys at $95,000. Do your own research and understand your personal risk tolerance. But for me, my approach is simple: dollar-cost average into Bitcoin, increase my position during oversold signals like the ones we’re seeing now, and continue buying even if prices dip further. The potential for lower prices doesn’t stop me.

So as you consider your next move, remember this: the future is bright, and I’m stacking sats all the way there.

I’ll catch you in the next one.

Cheers,