•

Uncovering a Tool That Reveals Bitcoin’s True Market Momentum

Bitcoin has this sort of hidden layer of market energy — subtle shifts in momentum, volume, and volatility that often go unnoticed. These forces build quietly, sometimes converging to ignite a rally, other times dissipating before the market even notices.

In this article, I’ll introduce you to a new powerful indicator that provides a window into this invisible world. It doesn’t just track price; instead, it measures the strength behind every move, revealing when bullish forces are aligning, when bears are gathering, and when the market is just downright indecisive.

Let’s get into it.

Momentum Coalescence: Blends momentum, volume, and volatility into a potent oscillator, surpassing single-factor indicators in capturing Bitcoin’s market energy.

Swing Trading Precision: Downside spikes and midline crossings flag high-reward entries, with past gains up to 200% in months.

Cycle-Timing Mastery: High readings signal peaks, low ones mark bottoms, and colour shifts track bull-bear transitions, preserving capital.

Market Snapshot: A 0.18 score shows consolidation, with short-term bearish pressure but bullish macro potential, priming for a breakout.

A New Way to Measure Momentum

As I preach time and time again, when it comes to technical and on-chain analysis, price is not the story. Beneath every rally and every crash, there are invisible forces at work — subtle shifts in momentum, volume, and volatility that most never see. That’s exactly why I’m introducing the Momentum Coalescence metric today.

This tool is built to measure the raw energy behind the market, showing when momentum is truly building, when bears are gathering, and when the market is simply pausing to catch its breath.

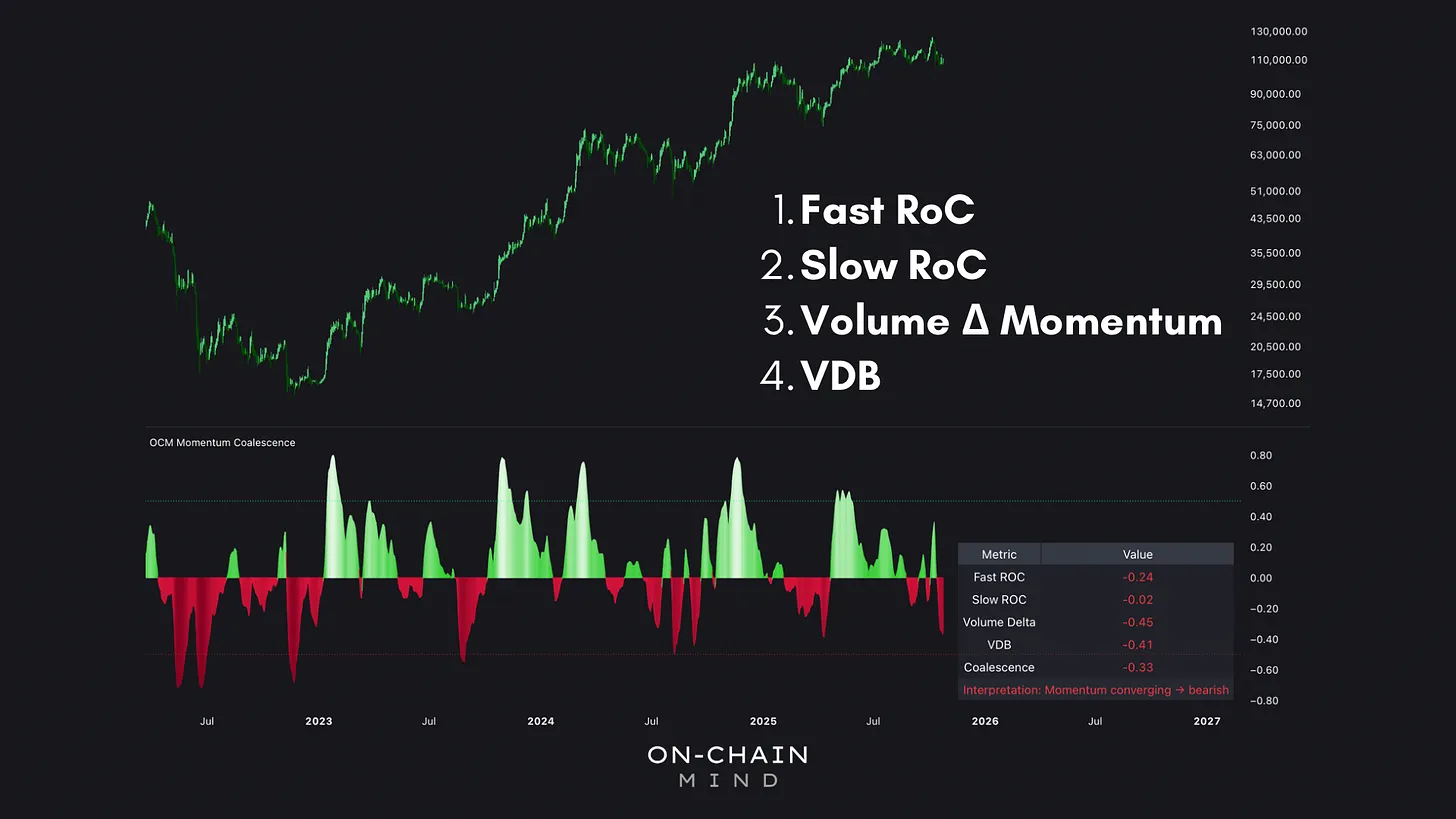

At its core, the metric is an oscillator designed to aggregate 4 distinct aspects of market behaviour. Here are its components:

Fast Rate of Change (Fast ROC) — measures short-term price momentum, providing an early signal of shifts in buying or selling pressure.

Slow Rate of Change (Slow ROC) — evaluates momentum over a longer horizon, capturing broader trends and reducing overreactions to short-term volatility.

Volume-Delta Momentum — tells you whether price moves are backed by genuine participation or just a handful of traders pushing the market. A rally without volume is a fragile one.

Volatility Directional Bias (VDB) — measures asymmetries in volatility and whether upward moves are more intense than downward moves (or vice versa). This shows you not just how volatile the market is, but which direction that volatility favours.

All 4 components are weighted, smoothed, and combined into the Coalescence Score. Check it out:

Positive scores indicate bullish convergence: accelerating prices, strong volume, and aligned upside volatility. Negative scores show bearish dominance, with fading momentum and downside bias. Near-zero values signal a market in limbo, caught between indecision and consolidation.

The Current Market Reading

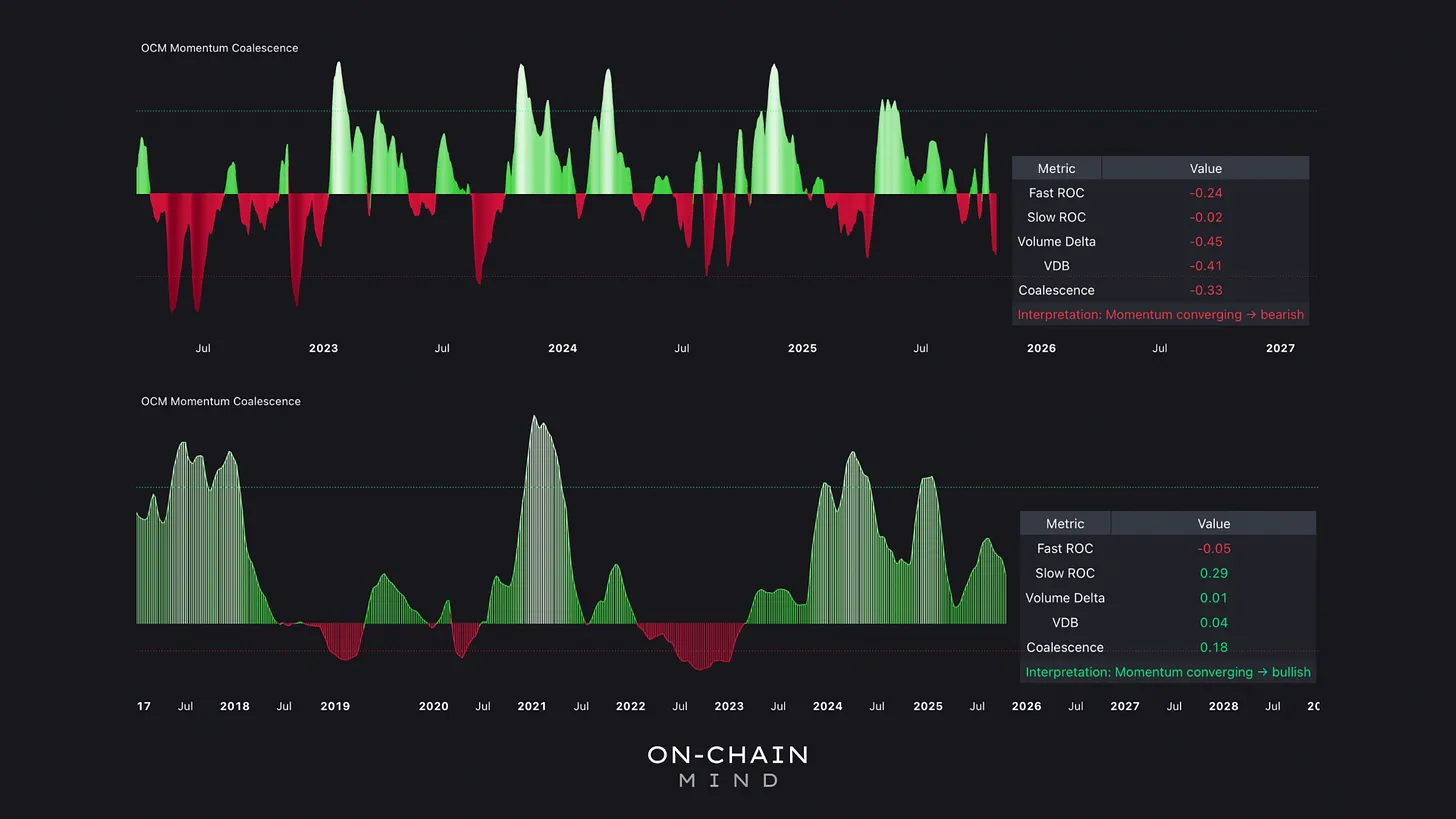

Right now, the lower timeframes are signalling a clear bearish convergence.Momentum is stacking against the bulls, volume is thinning, and short-term volatility is skewing to the downside. On the surface, it looks like the market is losing steam, and in the short term, that’s exactly what’s happening.

But when we zoom out, the picture shifts. Higher timeframes still carry bullish undertones: momentum is holding, underlying trends remain intact, and the broader structure shows no signs of a full trend reversal.

To me, this suggests we’re likely seeing a corrective dip within an ongoing uptrend rather than the start of a larger bearish cycle. And this aligns quite nicely with my last piece on the big leverage shakeout. The market is catching its breath and pushing out those weaker hands — a subtle but healthy recalibration rather than a true breakdown.

Currently, lower timeframes show bearish convergence, yet higher timeframes retain bullish undertones, suggesting a corrective dip within a broader uptrend.

Trading Applications: Extremes Deviations

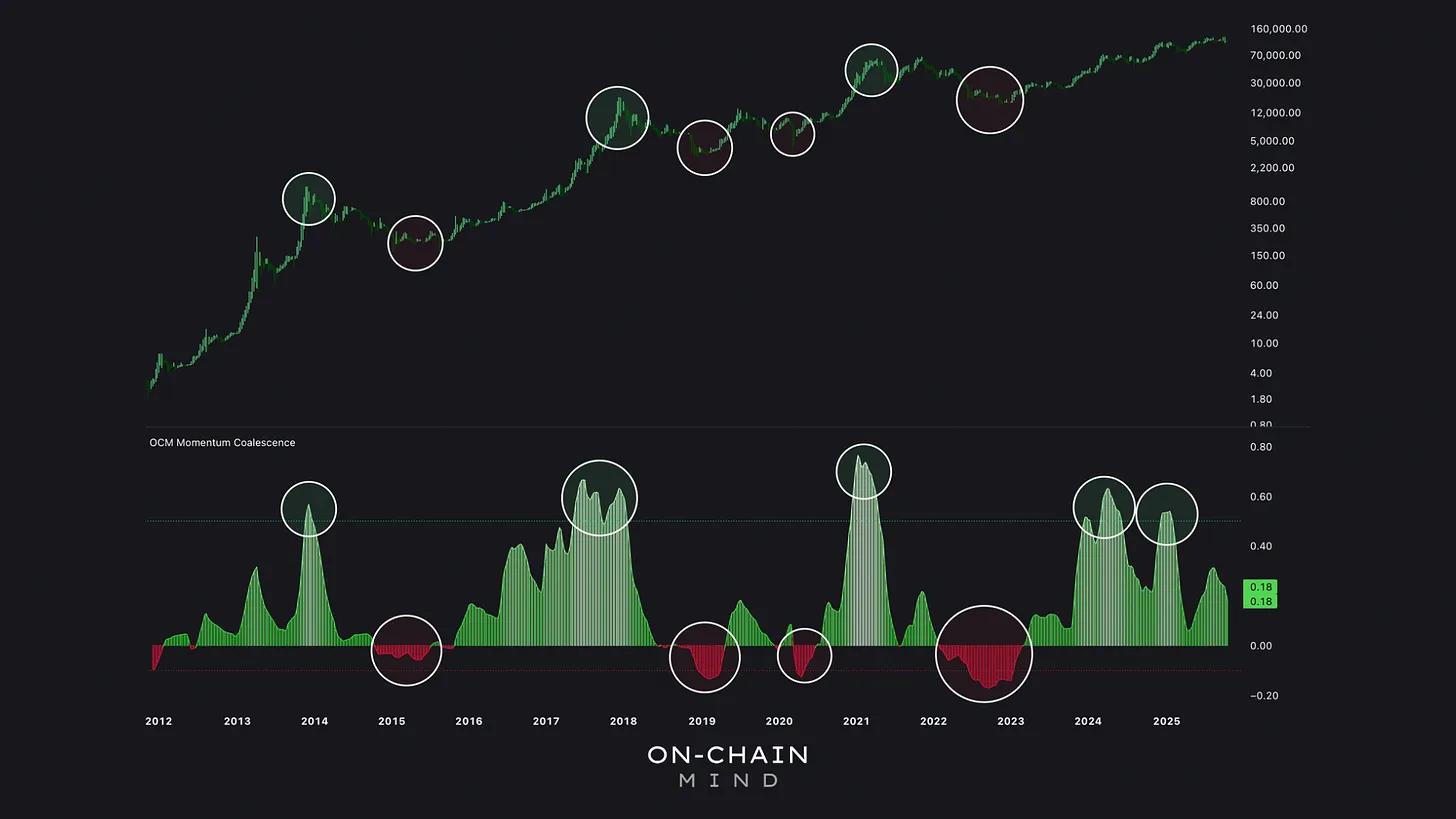

Historically, the largest negative deviations occur roughly once every 6 months, and these extremes often represent optimal contrarian entry points. While exact bottoms are impossible to predict, these readings highlight zones where bearish momentum is at its peak, offering high-probability opportunities.

A recent extreme downside deviation marked a rare moment of short-term capitulation. Historically, these points provide high-probability entry zones for the next upward leg as momentum begins to realign.

Midline Crossings

A slightly less aggressive approach involves monitoring when momentum crosses the oscillator’s midpoint. When momentum rises above this midline, it indicates accelerating market energy, while a fall below the midline suggests fading momentum and the need for caution.

Historically, rallies following midline crossings from extreme bearish readings have produced returns between 85% and 200% in just a few months. Late 2023 provides a textbook example: a deep red reading was followed by an 80% rally within two months.

Macro Cycle Tops & Bottoms

Beyond swing trading, the metric is invaluable for long-term macro cycle analysis. Readings above 0.5 often correlate with major cycle tops. While this metric doesn’t pinpoint exact tops, it acts as an early warning system. Conversely, deep red zones indicate decisive negative momentum, often highlighting long-term buying opportunities at discounted prices.

Presently, the metric reads 0.18, which is a moderate, consolidative reading that suggests the market isn’t at a peak nor in a bearish state.

Bull/Bear Trend Identification

One of the most effective uses of the metric is identifying trends. Exiting when the metric turns red can protect capital during bear markets, while re-entering when it flips green signals the resumption of bullish momentum.

2021 cycle example: exiting during red readings could have prevented a 66% capital drawdown, while re-entry on green would have aligned with the beginning of the next bull market phase.

My Take on Momentum Coalescence

For me, the true value of this metric lies in its unique ability to measure the market’s energy, not just price. It shifts the perspective from guessing where Bitcoin will go to observing where the market is likely to build or dissipate momentum. It’s one thing to see a price move; it’s another to understand whether that move is backed by conviction, volume, and aligned volatility, which are the forces that determine if a rally will run or fizzle.

From a swing trading standpoint, the metric highlights rare, high-probability entries, creating an asymmetric opportunity for those willing to act. Meanwhile, midline crossings let you ride trends as they develop, without the psychological trap of chasing extremes. It’s about stacking the odds in your favour and recognising when market energy is truly on your side.

On a macro level, it’s all about capital preservation. Bear markets are brutal when you’re caught off guard, but I’m hoping this metric gives us a lens to step aside, observe, and re-enter when the energy rebuilds.

Ultimately, it’s a reminder that Bitcoin’s movements are rarely random — they’re driven by alignment, conviction, and the ebb and flow of collective energy. To me, the metric is less a tool and more a lens: a way to understand when to act, and when to wait.

I’ll catch you in the next one.

Cheers,