•

mNAV Compression, Technical Warnings, and the Asymmetric Risk-Reward

MSTR price is collapsing and the market sentiment has flipped faster than anyone expected.

Over the past year, we’ve seen Strategy lose almost 60% of its value in Bitcoin terms, and the technical signals are now flashing bear market warnings for the first time this cycle. But before you panic, there’s also massive upside potential if Bitcoin rebounds and MSTR’s premium recovers.

In this article, I’m going to break it all down: why MSTR has underperformed, what the collapsing mNAV really means, the bearish and bullish technical scenarios, and exactly how I’m positioning my portfolio in the midst of all this carnage.

Let’s get into it.

Extreme mNAV Compression: MSTR has lost 60% in Bitcoin terms, outpacing Bitcoin’s 13% drop as its mNAV has crashed from 3.89x to 1.17x.

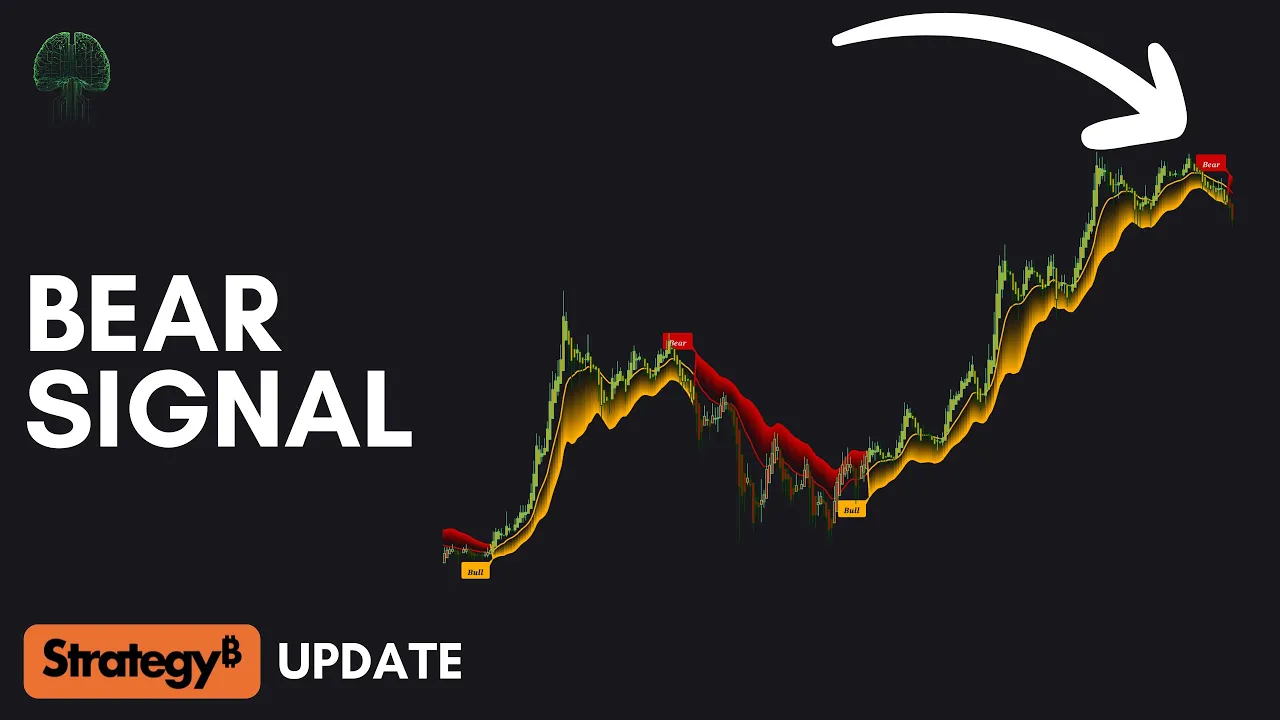

Bearish Technical Signals: Indicators like the Moving Average Cloud, MomentumCoalescence and Alpha Flow suggest a potential bear market ahead.

Bullish Upside Potential: If Bitcoin rallies and mNAV expands, MSTR could see 2x–4x returns from current levels in the medium-term.

My Current Strategy: I reveal my exact game plan with MSTR and how I aim to pragmatically manage my risk.

MSTR’s Underperformance: The Harsh Numbers

Let’s start with the hard truth: MSTR has lost nearly 60% in Bitcoin terms over the past year. Brutal. And yet, when we frame its performance in the context of the broader bull cycle, it’s a little more nuanced.

Since the start of this bull market, even with the recent decline, MSTR has more than doubled your Bitcoin-denominated wealth. At its peak, it even offered over 5x returns relative to a Bitcoin-only position. That’s a massive win for those of us who understood the asymmetric potential early on.

But the recent divergence cannot be ignored. From November 2024 until July 2025, MSTR tracked Bitcoin almost perfectly on a one-to-one basis. Then something changed. The extended chop and consolidation in Bitcoin shook sentiment hard. MSTR diverged dramatically: Bitcoin fell roughly 13% in USD terms over the past year, while MSTR fell over 30%, a more than 2.3x underperformance.

The question is why.

Since November 2024, MSTR’s stock has plummeted, losing nearly 60% of its value in Bitcoin terms while Bitcoin itself dropped only 13% in US dollar terms. This divergence is stark: MSTR’s decline is 2.3 times worse than Bitcoin’s.

The mNAV Meltdown

It’s tempting to blame execution, but that’s actually not the story here. MSTR’s “Satoshis per share” metric, the ultimate measure of Strategy’s success, has continued to increase quarter over quarter. Execution hasn’t failed.

The real culprit is mNAV, or market-to-net-asset-value premium. Back in November 2024, mNAV sat at 3.89x. Now, it’s collapsed to 1.17x. This compression explains almost all of MSTR’s Bitcoin-denominated losses.

The stock’s premium was its key driver of its outperformance, but it has now evaporated. Even if Bitcoin was reaching new highs today, the mNAV collapse would have negated those gains.

Why is mNAV Falling?

There are a few potential explanations:

Preferred Share Adoption Lag: MSTR’s preferred instruments (the various STRx products) are designed to generate Bitcoin yield without relying on ATMs. They’re still relatively unproven, which may be limiting investor confidence. Skeptics argue they are unsustainable, though that might be overly pessimistic.

Credit Market Pressure and Whale Participation: Fewer institutional players are willing to engage with MSTR’s leveraged Bitcoin strategy, and tighter credit conditions exacerbate the compression. This lack of demand contributes to mNAV suppression.

Cycle Timing Concerns: MSTR is inherently tied to Bitcoin. If investors sense that the bull market is maturing (or even that a bear market is imminent), they are naturally less willing to pay a premium. The mNAV reflects this market-wide fear.

In Nov 2024, mNAV stood at a 3.89x, meaning investors were willing to pay nearly four times the value of MSTR’s Bitcoin holdings to own the stock. By Nov 2025, this premium has collapsed to 1.17x, a level that reflects deep skepticism about MSTR’s execution. (Source: StrategyTracker.com)

The Monthly vs. Yearly Moving Average Cloud

Now let’s talk technicals. There are clear warning signs emerging that suggest MSTR could face a significant drawdown in the medium-term.

This here is my go-to macro indicator for identifying bull vs. bear markets. Comparing monthly and yearly moving averages provides a clear view of long-term trends.

Currently, the monthly line is rolling over rapidly, and if the trend continues, the cloud will flip red within weeks.

Historically, when the cloud turned red in the last cycle, MSTR fell over 74% from that point to the bear market bottom. Applied to today’s $240 level, this would imply a potential floor near $62. That’s a brutal drop.

Momentum Coalescence

I developed this to cut through noisy signals by fusing price acceleration, trend persistence, volume pressure, and volatility bias into a single metric. When all these forces align, we get a powerful macro signal.

Currently, the Coalescence is showing the largest negative spike since the last bear market began. In simpler terms: momentum is decisively bearish. This is a major signal that cannot be ignored.

Currently, the Coalescence is showing its largest negative spike since the last bear market began and much larger deviation than previous dips of this cycle (red oval). This suggests that bearish momentum is building, and a significant pullback could be imminent.

Alpha Flow

This identifies trend switches by tracking price movement relative to volatility-adjusted bands. Historically, it has been reliable for both Bitcoin and MSTR.

Right now, for the first time this cycle, it’s signalling a bear market ahead. This is a full alignment of market forces indicating the start of a potential massive medium-term correction.

We’ve just witnessed one of only four prints ever seen on the Alpha Flow signal since MSTR’s Bitcoin strategy’s inception, and it’s signalling a bear market is imminent.

How Low Could MSTR Go?

If Bitcoin enters a bear market from here, the downside is largely dictated by two factors: Bitcoin’s price action and MSTR’s mNAV.

Bearish Bitcoin Scenario: Suppose Bitcoin drops 50% from its all-time high of $126,000, landing near $63,000.

Bearish mNAV Scenario: If mNAV compresses further to 0.7–0.8, like in the previous bear, MSTR could trade between $95 and $101, which is roughly a 60%decline in USD terms.

While less extreme than the 74% drop suggested by the Moving Average Cloud, this scenario is still significant, especially relative to Bitcoin.

The Upside Potential

Even with these warning signs, MSTR remains highly leveraged to Bitcoin’s future performance. And this is where the risk-reward asymmetry becomes fascinating.

I use the 155-day VWAP Cost Bands indicator as a proxy of MSTR’s short-term holder realised price. Right now, MSTR’s 155-day VWAP sits at $351, while the current price is around $240. In other words, the stock is in probably the best buying zone of this bull cycle if you’re bullish on Bitcoin’s continued upside into 2026.

mNAV Expansion Potential

On the bullish side, mNAV could recover toward historical norms:

Historical norm: ~2.0

Peak sentiment scenario (November 2024): ~3.8

Assuming Bitcoin breaks its all-time high to a modest $130,000 and mNAV expands to these levels, MSTR could trade between $550 and $1,050.

That’s a 2x–4x return, which is a tantalising amount of potential upside for the bulls. But the key driver here is sentiment. If the market regains confidence in MSTR, the mNAV could rebound very sharply, and the price of Bitcoin would become only a secondary thought.

Potential upside targets, based on overstretched Cost Bands during a major bullish impulse, currently range from $630 to $770, which is roughly 2.5x–3x from today’s price.

My Current Take & Personal Strategy

As I sit here analysing MSTR, I can’t help but feel torn. On one hand, the technical signals are clear as day and are signalling caution. And that type of alignment is something we haven’t seen this cycle, and it suggests that MSTR could be on the cusp of a deeper correction. The mNAV compression is a stark reminder that the market’s love affair with MSTR as a Bitcoin proxy has cooled, and without a catalyst to restore confidence, the stock could face more pain. If you’re a short-term trader, these signals might be enough to make you cut losses or sit on the sidelines.

But then I look at the bullish case, and it’s hard not to get excited. MSTR’s current price feels like a fire sale for long-term believers in Bitcoin. With the mNAV near 1.0, the downside is still pretty significant, but the potential upside is astronomical if Bitcoin continues its climb and sentiment flips again. For those with a 10–20-year time horizon, buying MSTR at these levels could be like catching a falling knife that turns into a golden ticket. The risk-reward is wildly asymmetric, and that’s what makes MSTR so compelling, and yet so nerve-wracking.

Personally, I lean toward cautious optimism. I’m a Bitcoin bull, and I believe the macro environment still has room to run. But MSTR’s leverage makes it a high-stakes bet. If you’re considering jumping in, ask yourself: Can you stomach a potential 60% drop for the chance at a 4x gain? Your risk appetite and time horizon are everything here. For me, MSTR is a stock that demands respect for its volatility but also rewards those who can weather the storm. Whatever you choose, don’t follow the crowd blindly.

What I’m Doing With My Portfolio

Now here’s my personal take on all of this. MSTR has always been a relatively small part of my portfolio compared to Bitcoin, but that key line in the sand at the $280 level I talked about forced me to seriously revisit my thesis. And we can’t ignore history here. In the previous cycle, MSTR topped and rolled over before Bitcoin did. That actually happened. And because it happened once, we have to treat it as a legitimate scenario this time too.

Now, as I explained in my most recent article, I don’t believe the Bitcoin bull run is over. I’m still about 70% convinced we continue higher, and 30% that we transition into a bear market. But acknowledging that I could be wrong, and seeing the number of bearish macro signals that are now triggering for MSTR, I’ve taken steps to de-risk, without stepping out of the market entirely.

I haven’t sold into cash, but I have rotated around 30–40% of my MSTR position directly into Bitcoin. And this shift has been made a lot easier recently with the approval of Bitcoin ETPs in the UK, which finally allow us to hold Bitcoin exposure in tax-free accounts. For years, MSTR was the only way to do that. Now it isn’t. So I no longer need to rely on MSTR as my only tax-efficient Bitcoin proxy.

That said, for retirement accounts here in the UK, MSTR is still the only reliable vehicle for Bitcoin exposure. And because I won’t access those accounts for decades, these compressed valuations actually present an incredible long-term opportunity. So in those accounts, I continue to hold a large allocation to MSTR and I’ve actually been heavily adding to my positions in there at these levels. Even if a short- or medium-term drawdown is likely, the multi-decade time horizon I’m locked into here completely changes the risk-reward profile.

To be clear: I still believe in MSTR’s long-term projections, even if the near-term setup looks increasingly bearish. And this is where discipline matters. Don’t flip bearish at the bottom and bullish at the top. You have to do the opposite. That’s why I’m rebalancing, not rage-selling.

I’m not fully exiting my MSTR position — in fact, far from it. MSTR has a proven history of generating more Bitcoin for me than simply just holding spot BTC over the long run. But managing risk is not optional. It’s mandatory. So I’m adjusting my exposure, respecting what the data is telling me, and making sure my allocation reflects both the upside potential and the very real short-term risks.

I hope this helps with any difficult decisions you’re having with your portfolio.

Best of luck.

I’ll catch you in the next one.

Cheers,