•

Plus on-chain health, neutral funding, and the one signal still missing for a true bottom

Bitcoin is sitting right on top of the line that decides whether we’re still in a healthy bull cycle, or about to fall off a cliff.

In this article, I’m diving into the True Market Mean, on-chain capital flows, leverage resets, and the volatility signal that reveals if Bitcoin is consolidating for a new leg up or if a structural risk still lurks beneath the surface.

Let’s get into it.

The True Market Mean: Filters out lost or dormant coins, showing the real cost-basis centre for active Bitcoin traders.

Persistent Positive Capital Flow: Net capital entering Bitcoin remains positive despite recent selling, unlike true bear markets.

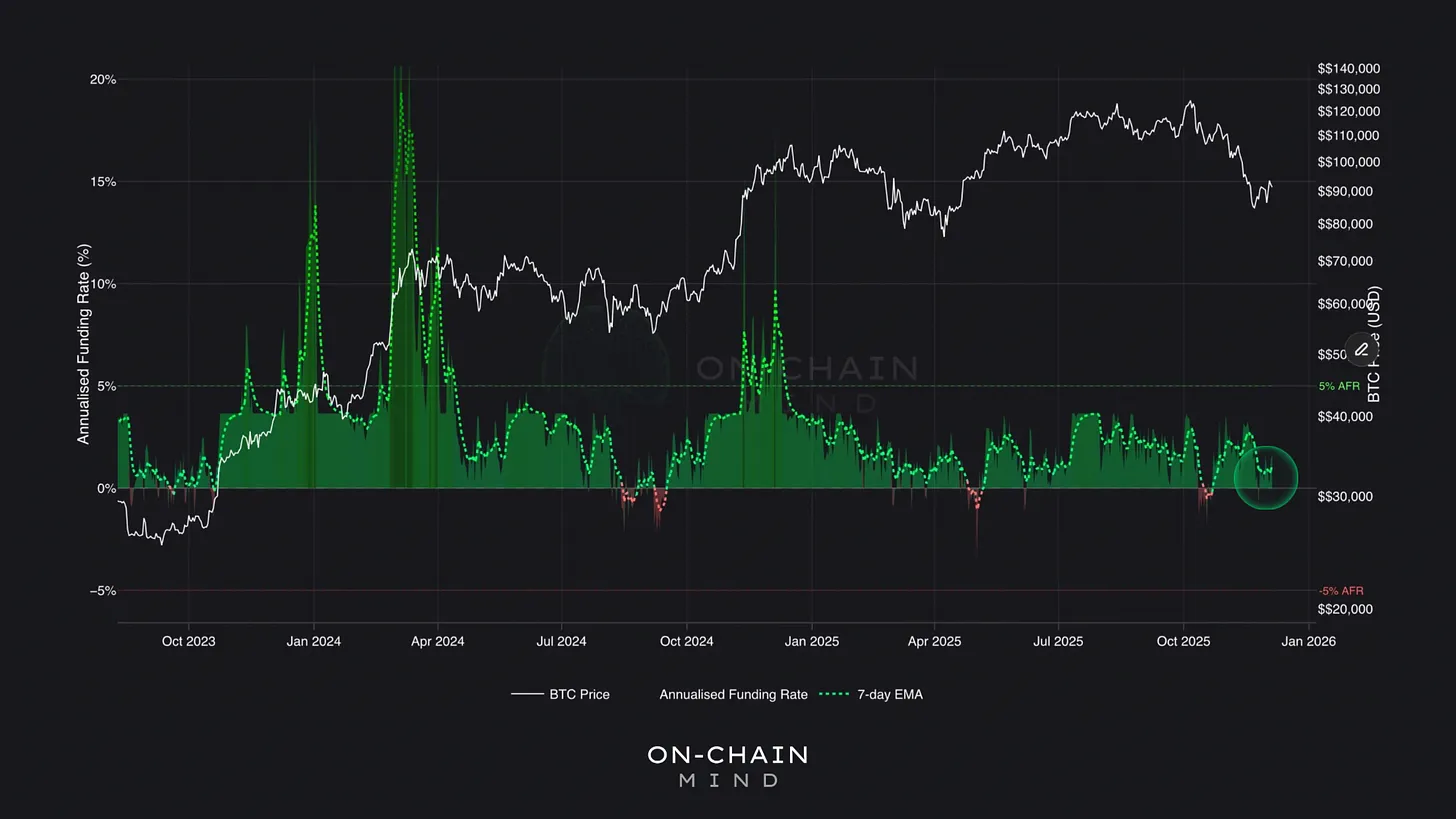

The Leverage Reset is Complete: Excessive speculative longs have been cleared, funding rates neutralised, and downside fragility significantly reduced.

The Final Hurdle: Volatility Fractals haven’t reached low-intensity levels, meaning fear and structural volatility risk persist.

The Market’s Gravitational Centre

If you’ve been subscribed for a while, you’ll have heard me talk many times about the classic Realised Price, which is the aggregate cost basis of every single UTXO valued at the price when it last moved.

It’s useful, on average, and serves as a fantastic long-term support level. But it has a fatal flaw: it treats a coin lost in 2011 the same as a coin actively traded yesterday.Over time, those ancient, effectively dead coins drag the average lower and lower, making the metric progressively less representative of the current market.

The True Market Mean (TMM) fixes this by introducing a concept called “Liveliness”. At its core, liveliness is a genius way to measure the network’s economic activity. It essentially compares two opposing forces:

Dormancy (HODLing): Coins sitting idle in long-term holding wallets, not moving.

Distribution (Spending/Selling): Old coins, often from long-term holders, being moved and spent, typically into the hands of new, active buyers or onto an exchange for selling.

By adjusting the Realised Price calculation to account for this liveliness concept, the TMM effectively discounts lost and truly long-term dormant coins. The result is an average cost basis that reflects only the economically active participants: speculators, traders, institutions, and newer holders who actually capable of selling today.

Statistically, this adjusted mean hugs the geometric middle of Bitcoin’s entire price history with uncanny precision. It is quite literally the market’s centre of gravity.

When price is above it → active cohort in profit → psychological and financial incentive to hold or buy dips.

When price breaks and holds below it with volume → active cohort in loss → incentive structure flips toward capitulation.

Every major bear market saw price collapse through this level and then trade beneath it for many months. And every meaningful bull market has reclaimed and held it as support.

Right now, Bitcoin bounced cleanly off the TMM at ~$81,000. Until that changes, my base-case remains constructive.

Bitcoin’s True Market Mean

Capital In, Capital Out

Price tells you what happened. Capital flows tell you why it happened.

The Realised Capital Flows metric tracks the net movement of value into and out of Bitcoin via realised profits and realised losses.

If the coin is sold for a higher price, a Realised Profit is recorded. This represents new capital being effectively re-valued higher within the system, or new cash inflow.

If the coin is sold for a loss, a Realised Loss is recorded. This represents capital being subtracted from the system, typically by people pulling out at a loss.

Aggregate these across millions of coins, and you get a live measure of whether the ecosystem is absorbing capital or losing it.

And here’s what’s fascinating: even with the recent selling pressure, net capital flows are still positive.

Yes, the pace has slowed from earlier in the year, but they haven’t flipped negative, and historically, that’s the key threshold. Every major crash, capitulation, or cycle-ending bear market shows a clear signature: sustained negative capital flows. It’s one of the cleanest signs that the average participant has stopped absorbing new supply and is instead offloading into weakness.

We are simply not seeing that kind of behaviour.

What we’re seeing instead is a deceleration, a normal cool-down phase where inflows slow, profits moderate, and the market absorbs selling without tipping into aggregate loss. As long as capital flows remain positive, the True Market Mean can act as a consolidation zone and a base for market restructuring, rather than the trapdoor of a new bear leg.

This is the difference between cyclical fear and structural collapse. The former is noisy. The latter is unmistakable, and we’re not in it.

Bitcoin Realised Capital Flows 30-day Δ

The Leverage Reset

Nothing accelerates downside like a mountain of over-leveraged long positions. When price drops, margin calls force more selling, which triggers more margin calls. A classic liquidation cascade.

For most of 2025, perpetual funding rates stayed stubbornly positive (longs paying shorts) even as price fell. Traders kept trying to catch the falling knife with leverage. But now, the tone has shifted.

Perpetual funding rates have cooled into neutral territory. That alone tells you something important: fear is present, but not overwhelming. Traders aren’t suddenly piling into aggressive short exposure, they’re simply being more cautious.

This is exactly what a healthy reset looks like.

A neutral funding environment is one of the cleanest preconditions for a durable bottoms. It means:

No overcrowded directional exposure to create cascading liquidations.

Room for price to move up without immediately reigniting insane leverage.

Psychological breathing space for spot demand to re-assert itself.

For the first time in months, the derivatives landscape is no longer a liability. The leverage bomb has been largely defused.

Bitcoin’s Annualised Perpetual Funding Rate

The Final Hurdle

If there is one metric that still isn’t playing ball, it’s the Volatility Fractals. This is a volatility clustering model that identifies pivot points and compresses them into an intensity curve.

Low Fractal Reading: Indicates market consensus, a quiet, flat environment associated with institutional-style accumulation or deep consolidation.

High Fractal Reading: Indicates market chaos, uncertainty, and high distributional or capitulatory volume.

Right now, the readings remain elevated.

Not as wild as the October spike, but still high enough to be categorised as instability rather than accumulation.

For a sustainable bottom, volatility needs to contract into the quiet low single digit intensity range. That’s where fear dissolves, the markets normalise, and where liquidity finds its balance again. It’s also where price becomes boring. And in Bitcoin, boring is usually bullish.

Until that compression happens, structural volatility-driven downside risk is still alive. We’re progressing, but we’re not fully cooled down yet.

Bitcoin’s Volatility Fractals

My Take & The Risk of Impatience

It is tempting to look at a successfully de-risked derivatives market and today’s strong on-chain fundamentals and declare the correction over. But to do so is to ignore the historical playbook of post-volatility consolidation.

My personal observation is that the biggest risk to investors right now is not a systemic collapse, but impatience.

The truth is, Bitcoin rarely V-shapes after a 30%+ drawdown inside a macro bull market. What it does is bleed out leverage, bleed out weak hands, and then brutally bore everyone to death for weeks or months while volatility compresses.

That boring period is when institutions and high-conviction money quietly accumulate. It’s also the period retail hates the most, because there’s no quick 180° recovery to validate their impatience.

After any large volatility event, Bitcoin’s market structure typically demands a period of horizontal compression and emotional cooling. This necessary cooling phase is not a dramatic event; it is a slow, often boring grind where conviction is quietly established and remaining fear is absorbed. That’s exactly where I believe we are now: Phase 1 of a multi-phase bottoming process.

Phase 1: Leverage flush + True Market Mean defence + capital flows still positive.

Phase 2: Horizontal consolidation + volatility compression (fractal intensity dropping).

Phase 3: Breakout once spot demand returns in full force (likely) through a macro-driven catalyst.

The conditions are overwhelmingly favourable for a move toward a sustainable floor. The foundations are solid, the capital is still net positive, and the structural debt (leverage) has been paid.

But until the market gets suitably, thoroughly bored, the chaotic price action may persist. The ultimate test of this bottom will not be another spike but a sustained period of quiet, low-intensity trading. The market has done the hard work of deleveraging; now it must do the quiet work of consolidating.

The conditions are aligning. But the final cooling phase is still ahead.

We’re not there yet… but we’re undeniably on the path.

I’ll catch you in the next one.

Cheers,