Bitcoin Options Max Pain

onchainmind.io

© 2025 On-Chain Mind. All rights reserved.

Description:

Premium Indicator

Premium Indicator

Indicator Overview

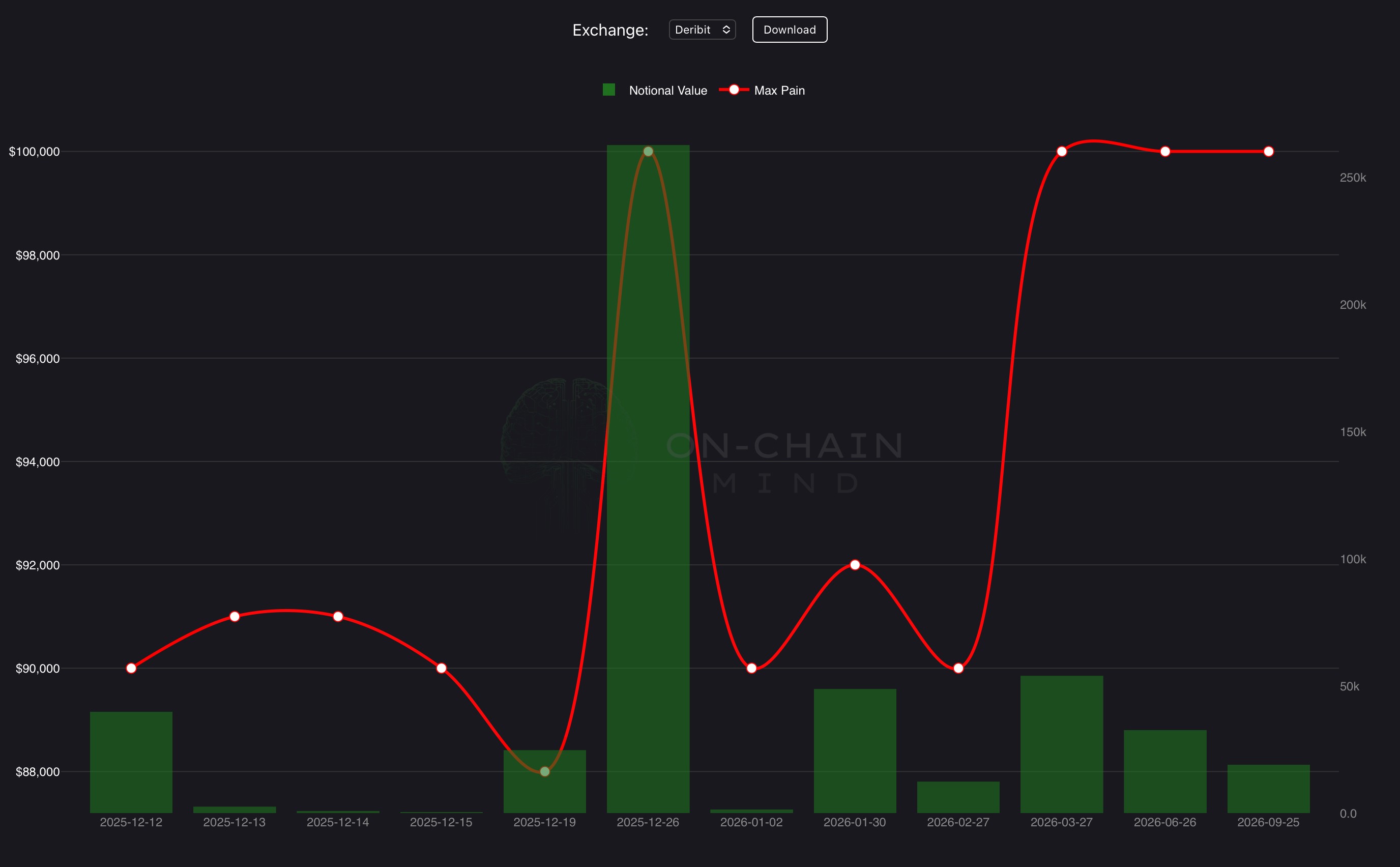

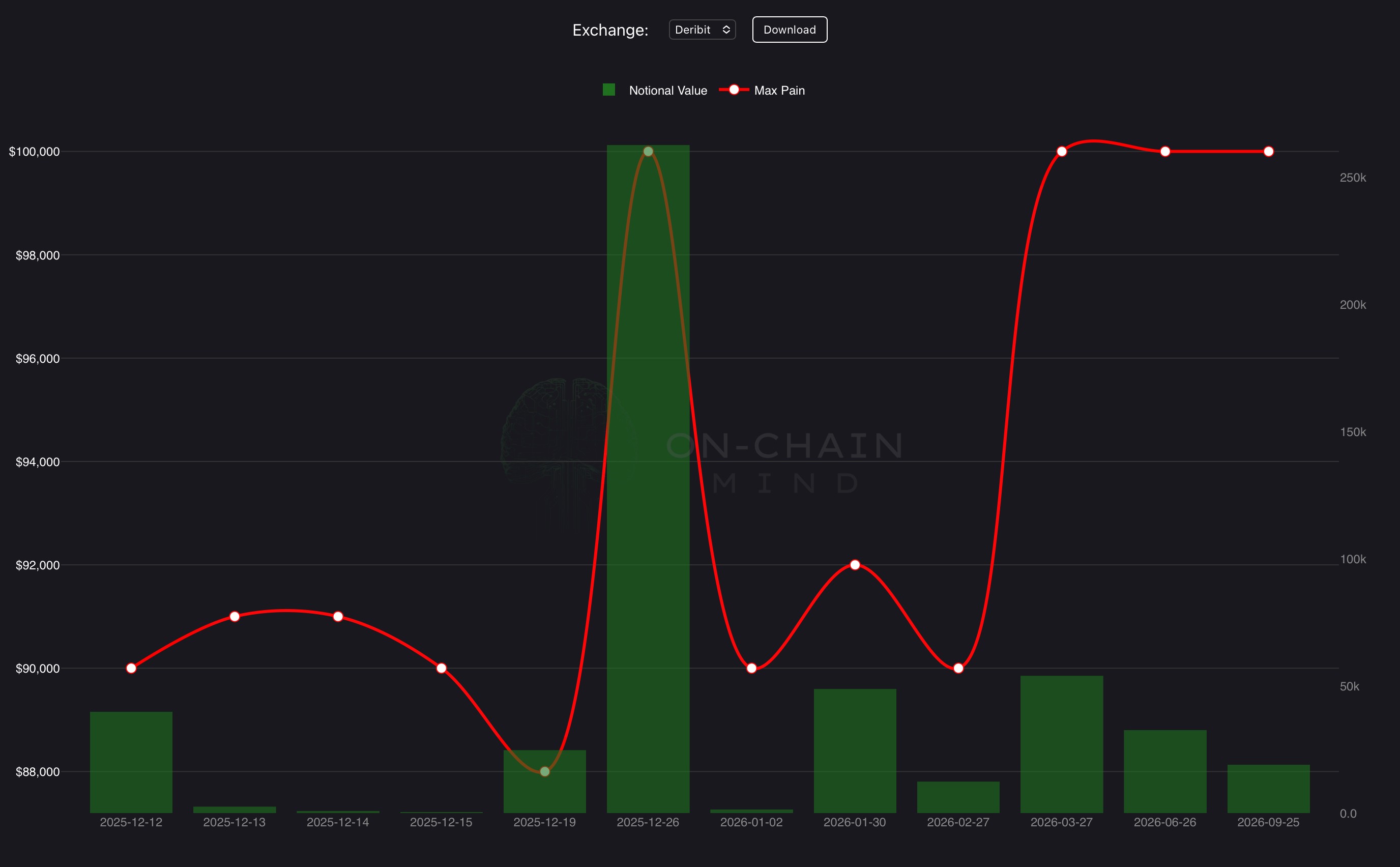

The Bitcoin Options Max Pain Price indicator calculates, for each weekly or monthly expiry, the strike at which the combined dollar value of in-the-money calls and puts would expire worthless for the greatest number of option holders. This theoretical “pain point” is plotted as a bold red line with white markers, while total open interest (in contracts) across all strikes is shown as green bars on a secondary axis. The chart updates daily for the three largest venues (Deribit, Binance, OKX) and reveals the price level that would inflict maximum financial pain on option buyers at expiry.

How To Use

Convergence of spot price toward the red Max Pain line as expiry approaches is one of the strongest forces in Bitcoin options markets, driven by market makers and gamma hedging that pushes price toward the strike where the most contracts expire worthless. Large gaps between current price far above Max Pain act as powerful magnets for downward pressure in the final days, while price far below Max Pain creates upward gravitational pull. Traders use the red line as a high-probability mean-reversion target in the last 48-72 hours before settlement, especially when open interest is heavily concentrated. Divergences are equally valuable: price remaining stubbornly away from Max Pain despite heavy OI often signals impending violent squeezes in either direction. Monitor the red line as the single most influential short-term anchor in Bitcoin price action during expiry weeks, the strike where the market collectively wants Bitcoin to close.

Copyright © 2025 On-Chain Mind