Days Spent In Loss

onchainmind.io

© 2025 On-Chain Mind. All rights reserved.

Description:

Premium Indicator

Premium Indicator

Indicator Overview

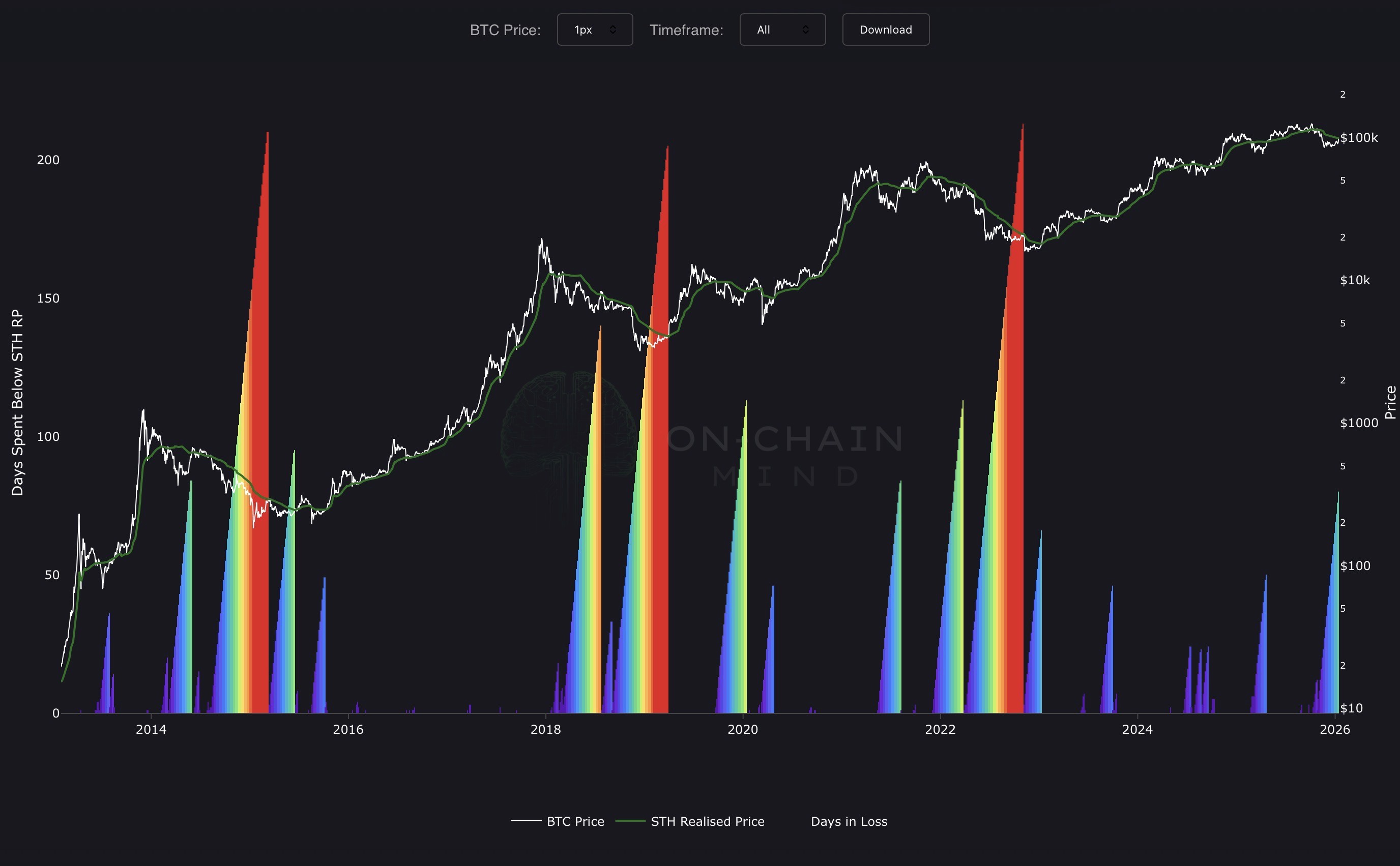

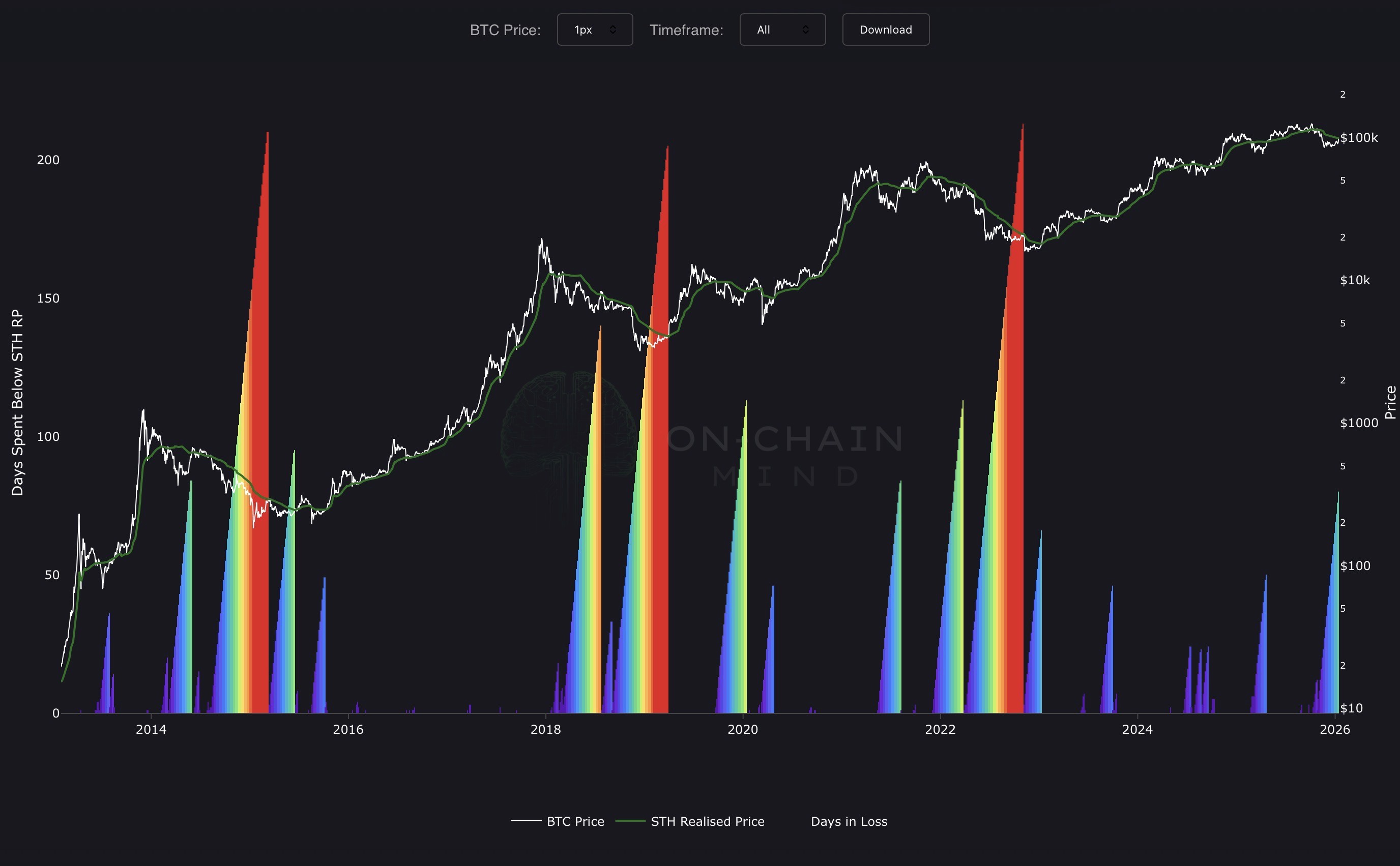

The Days Spent In Loss is a sentiment-driven momentum tool that quantifies the duration of market distress for Bitcoin's most reactive cohort: Short-Term Holders (STHs). By tracking the consecutive number of days the Bitcoin market price remains below the STH Realised Price (the average acquisition cost for coins moved within the last 155 days), the indicator effectively measures the psychological "patience test" currently facing new market entrants.

The indicator is visualised as a rainbow-coloured histogram. The counter begins at 1 the moment price dips below the STH cost basis and increments daily until a recovery occurs. The 16-step palette shifts from cool purples and blues (early-stage distress) into warm oranges and deep reds (prolonged capitulation). This visual fanning provides a clear macro perspective on seller exhaustion; the longer the bars grow, the higher the probability that short-term speculators have been flushed out, often marking cycle bottoms.

How To Use

Traders can use this indicator to identify capitulation overextension. Historically, Bitcoin bull markets are characterised by price trending above the STH Realised Price (the green line). When price breaks below this level, the appearance of the first purple bars serves as a primary warning that a bearish regime shift or a significant correction is underway.

The Red Zone (approaching the 155-day threshold) is particularly significant. When the histogram reaches these extreme warm colours, it suggests that short-term holders have been underwater for a duration nearly equal to their entire cohort definition. Historically, these deep red clusters coincide with macro capitulation events and generational buying opportunities. Conversely, the moment the histogram resets to zero, it signals a "Golden Cross" between spot price and STH cost basis, confirming that the average recent buyer is back in profit and that bullish momentum has been restored.

Copyright © 2025 On-Chain Mind