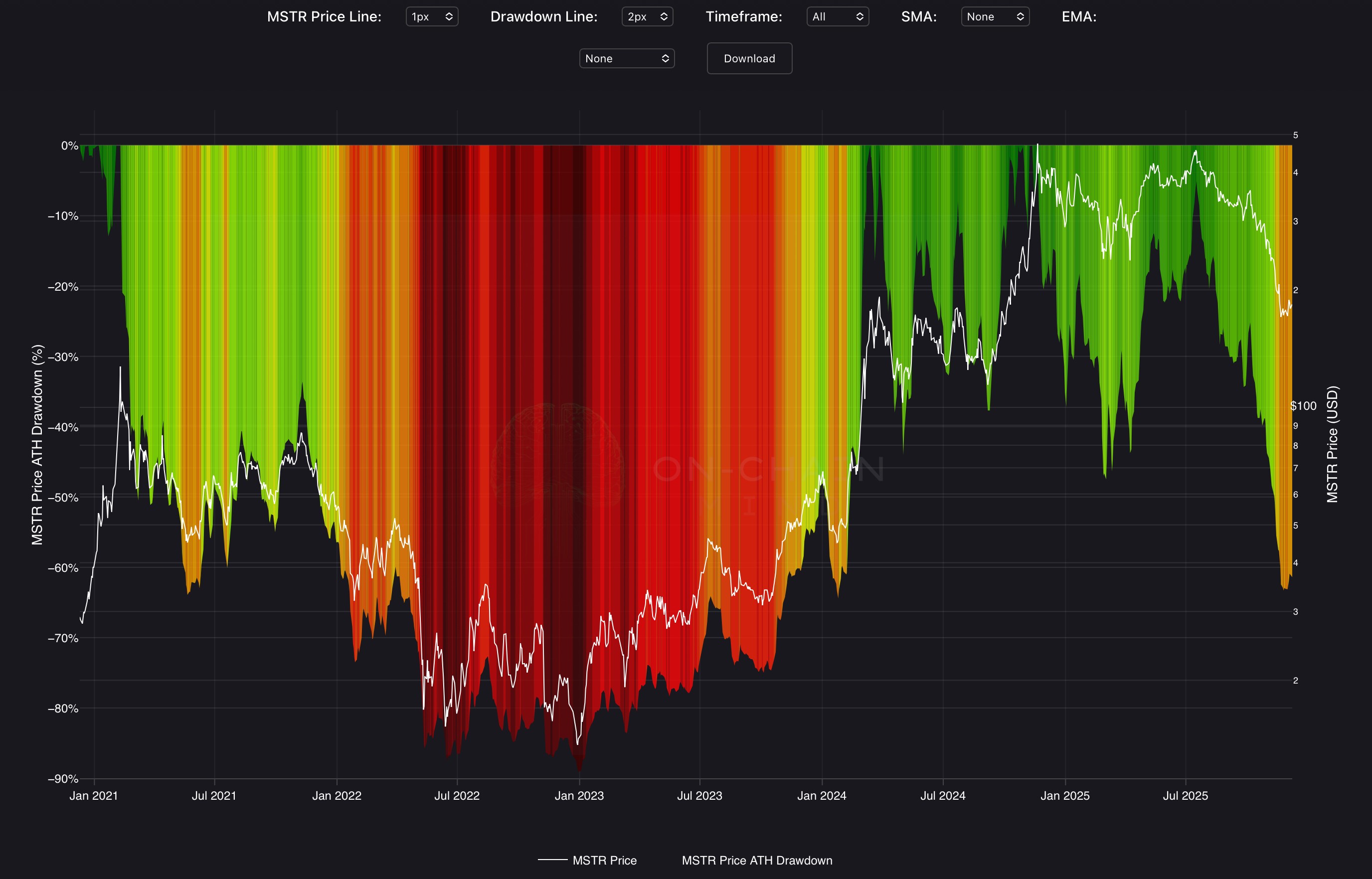

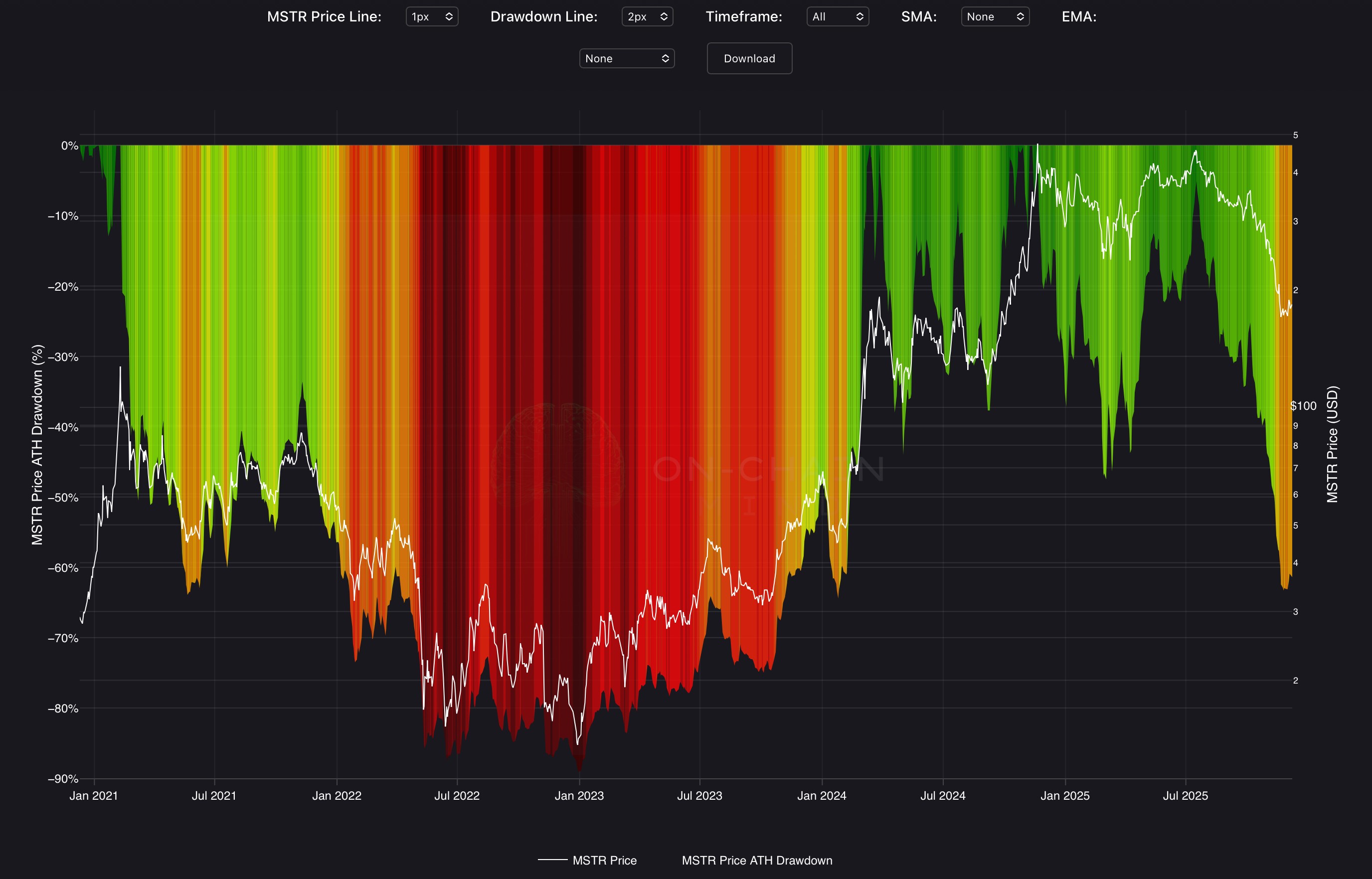

MSTR Price ATH Drawdown

onchainmind.io

© 2025 On-Chain Mind. All rights reserved.

Description:

Premium Indicator

Premium Indicator

Indicator Overview

The MSTR ATH Drawdown indicator measures Strategy’s percentage decline from its prevailing all-time high (ATH), displayed on a continuous gradient from bright green (near 0 % fresh highs, peak euphoria) through yellow and orange to deep blood-red (extreme drawdowns beyond -80 %). MSTR’s share price is overlaid on a secondary logarithmic axis, enabling instant visual comparison between absolute price levels and the depth of correction from the cycle peak. This tool is specifically calibrated to capture MSTR’s amplified drawdowns caused by premium compression and depressed sentiment making it an essential gauge of cycle maturity, capitulation risk, and recovery potential in this leveraged Bitcoin proxy.

How To Use

Deep red zones below -70 % have historically marked maximum pain and capitulation, the exact moments when premium collapses to its lowest levels, creating some of the strongest generational buying opportunities in MSTR’s history.

Persistent green near 0 % signals extreme overextension and parabolic tops, often the final stage of debt-fuelled rallies or post-announcement euphoria, ideal for profit-taking, hedging, or short exposure before violent mean reversion.

Rapid upward breaks from red territory confirm new bull cycles and justify aggressive re-entries, while failure to reclaim prior highs after prolonged orange/red drawdowns warns of structural weakness.

The zero-line acts as the ultimate regime divider: sustained trading above confirms bullish leadership, while repeated failures below increasingly validates bearish control.

Traders use the deepest red extremes as high-conviction accumulation signals, green persistence as distribution warnings, and the speed of recovery from lows as confirmation of new cycle strength, transforming this simple drawdown metric into one of the most powerful cycle-timing and risk-management tools available for MSTR investors.

Copyright © 2025 On-Chain Mind