Volatility Waves

onchainmind.io

© 2025 On-Chain Mind. All rights reserved.

Description:

Premium Indicator

Premium Indicator

Indicator Overview

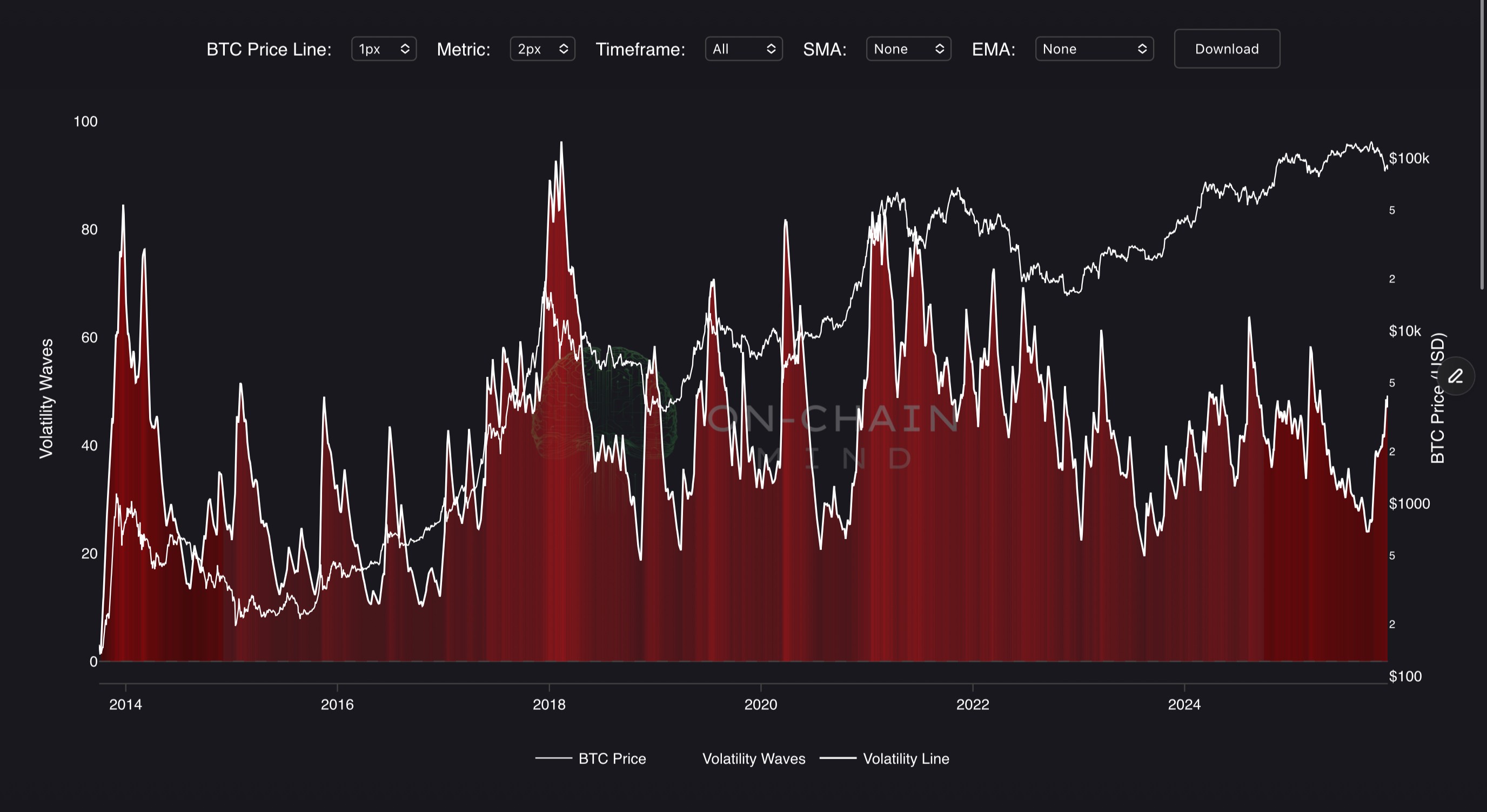

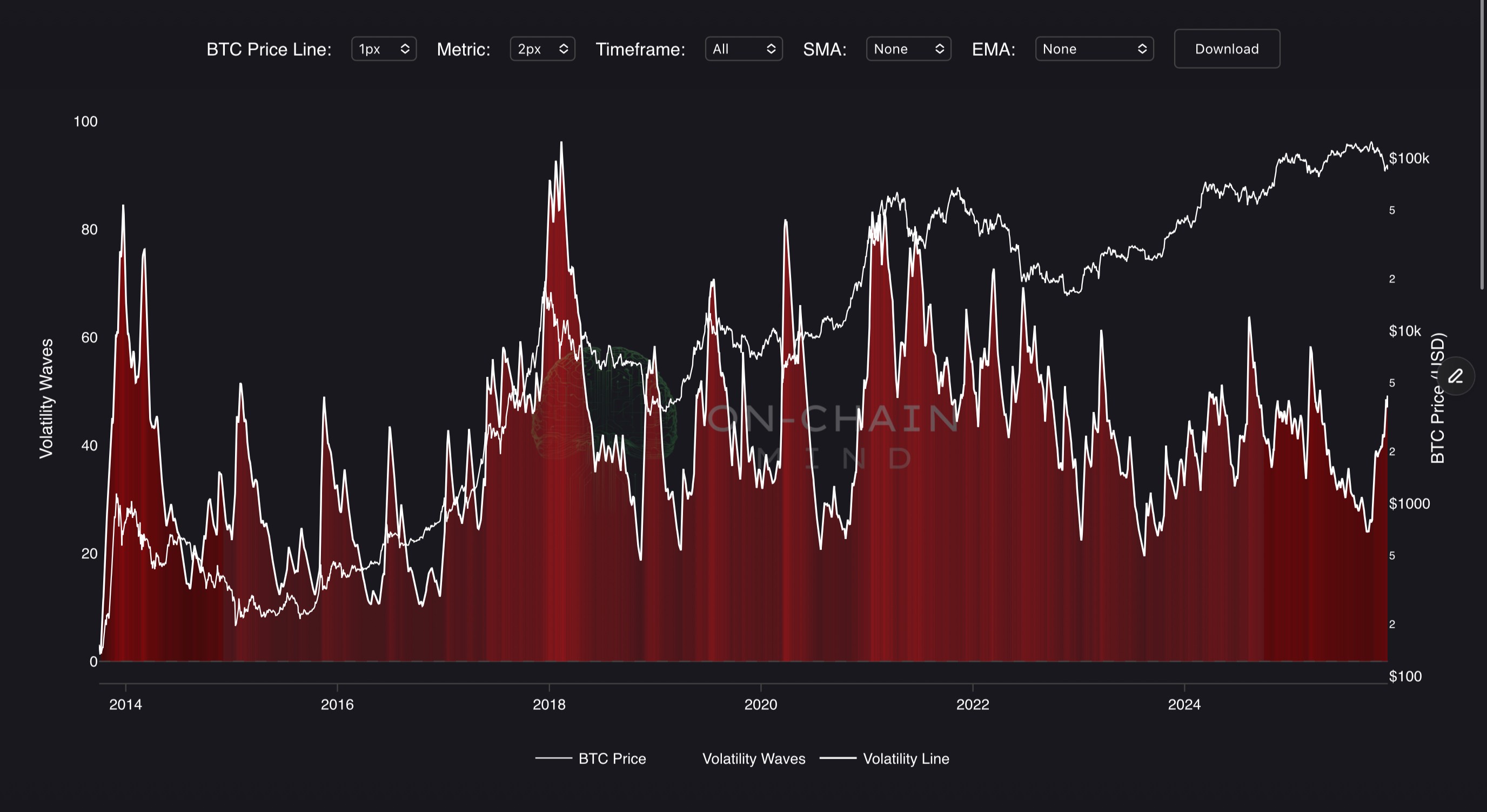

The Volatility Waves indicator measures the volatility of Bitcoin’s price using a seven-day logarithmic return calculation, smoothed and scaled to highlight market cycles. It reflects the intensity of price fluctuations, offering insight into market sentiment and potential turning points. Volatility is a critical metric for Bitcoin, as it often signals periods of accumulation, euphoria, or capitulation within its cyclical market structure. By tracking short-term volatility, the indicator helps investors identify phases of heightened activity or consolidation, making it valuable for assessing market dynamics and timing entries or exits. Its cycle maturity scaling option adjusts for Bitcoin’s evolving market behaviour, enhancing long-term relevance.

How To Use

Historically, high volatility spikes often coincide with Bitcoin price peaks or sharp capitulation events. Low volatility periods typically indicate consolidation or accumulation phases, often preceding significant price moves. You can use rising volatility to anticipate potential reversals or breakouts, while declining volatility may suggest a stable range or impending momentum shift. For investment, high volatility zones may signal caution, prompting profit-taking or risk management, while low volatility could indicate opportunities for accumulation. But try to avoid relying solely on volatility due to its lagging nature.

Copyright © 2025 On-Chain Mind