•

Why momentum and participation are quietly drying up

Most investors spend bear markets waiting for mass panic. The capitulation candle. The emotional flush. The moment where everything finally feels unbearable.

That moment rarely marks the end.

Bear markets don’t die screaming. Instead, they normally end with something far more deceptive: a slow, grinding exhaustion. It stops when there’s nothing left to sell, no urgency left to transact, and no momentum left to push price meaningfully in either direction.

In this article, I want to walk you through 2 indicators I personally rely on to assess whether bearish energy in Bitcoin has genuinely been exhausted. They’re not popular. But historically, they’ve been far better at identifying regime shifts than almost anything else out there.

Let’s get into it.

Bear Markets End Through Exhaustion, Not Panic: Markets do not always end with a bang; frequently, they end when the last bit of selling pressure is depleted.

The Structural Signal: The Bull Momentum Gauge signals regimes shifts from bear to bull and confirms when risk conditions truly change.

Miner Revenue Reveals Network Behaviour: Transaction fees expose real demand, urgency, and speculative pressure (or the lack of it), and lines up perfectly with market extremes.

Price Can Rise While Participation Falls: The “slow-bleed” scenario we spoke about months ago is looking like it’s playing out in real time.

A Core Misconception

One of the biggest mistakes investors make is assuming that markets bottom when conditions feel the worst. When sentiment is horrific. When everyone has given up.

That emotional low usually arrives well before the actual structural low.

Markets bottom when the damage has already been done. When sellers have already sold. When bad news no longer produces new downside. When energy (not fear) has been exhausted.

That distinction matters, because fear is subjective and noisy, exhaustion is mechanical, and it all shows up in the data.

Structural Momentum

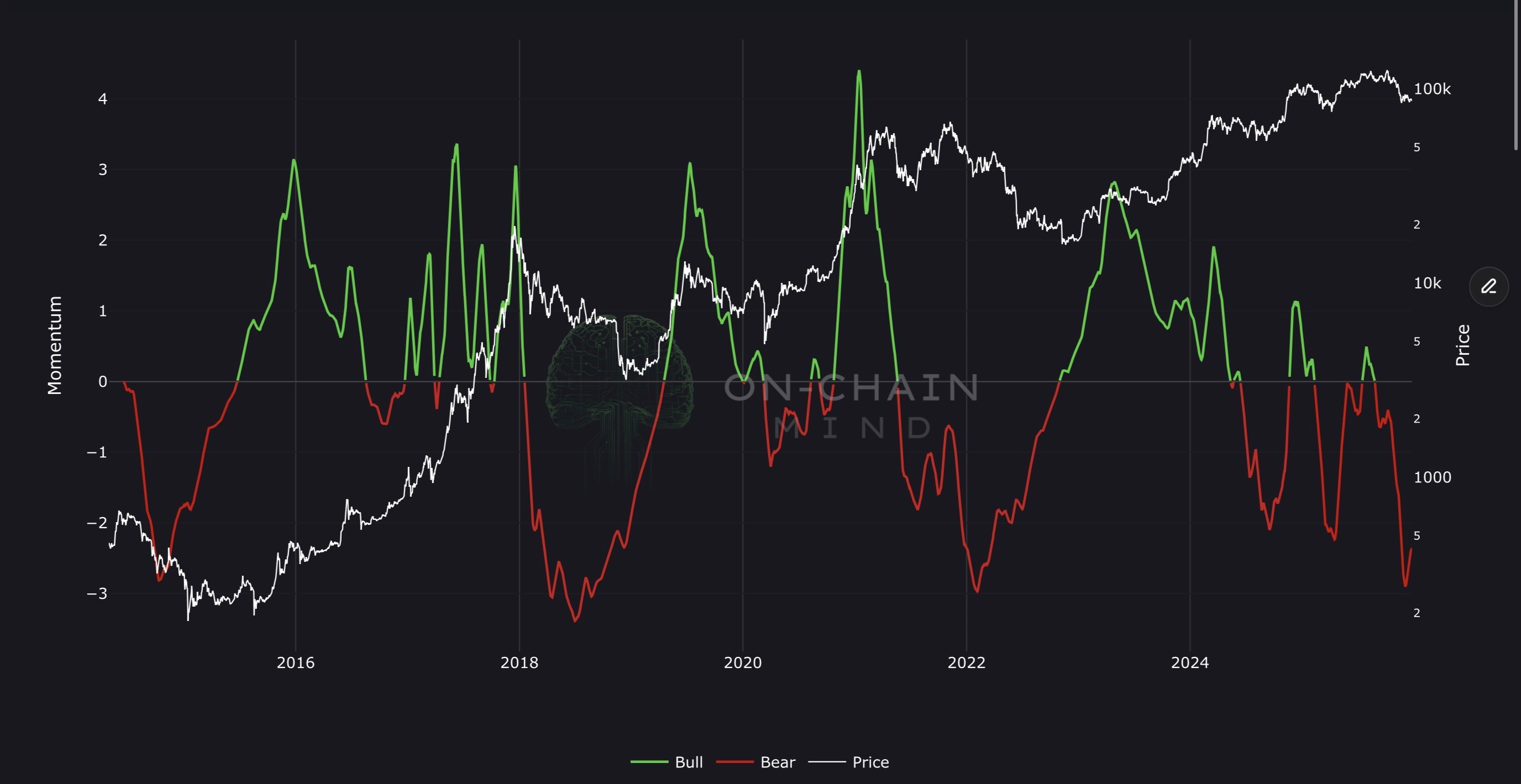

Let’s start with the Bull Momentum Gauge, which is a powerhouse indicator that distils complex price dynamics into a clear signal of structural momentum. At its heart, it’s about quantifying how Bitcoin’s price deviates from its long-term trend in a statistically meaningful way.

In technical terms, we take that deviation and convert it into an inverted Z-score, which is then smoothed by a 200-day moving average. This process achieves two critical things for a long-term investor:

1. Standardisation: It doesn’t just ask if the price is low; it asks how abnormal the current price action is compared to the historical norm.

2. Filtering: By using a 200-day average of that Z-score, it ignores the fake-outs and "dead cat bounces" that plague bear markets.

When this gauge crosses into the green zone, it signals a regime shift. It tells us that the probability-weighted environment has flipped. We are no longer in a sell-the-bounce market; we have entered a buy-the-dip market. At present, this metric has been sitting at some of the deepest red levels in history.

However, the depth of the red isn't the signal. The turn is. We are looking for the moment the red stops getting redder and begins a decisive climb back toward the green.

That transition tells us several things simultaneously:

Selling pressure has already done its job

Negative deviation is no longer expanding abnormally

Momentum is rebuilding from a compressed base

In previous cycles, these shifts occurred after most of the damage was already behind us. They didn’t catch the exact bottom, and they’re not meant to.

They catch the change in character. The moment rallies stop being countertrend bounces and start becoming something structurally different.

Right now, the Bull Momentum Gauge remains deeply suppressed. And at this stage, it feels reasonable to say we are likely past the halfway point of this process, but we’re not out of the woods yet.

Bitcoin Bull Momentum Gauge

Network Vitality

While price tells us where we are, network behaviour tells us who is there. The Block Subsidy to Transaction Fees Ratio is perhaps the most underappreciated sentiment indicator in Bitcoin.

This metric tracks how much of miner revenue comes from transaction fees vs. newly issued Bitcoin. It’s expressed as a percentage and moves from deep green (subsidy-dominated) to vivid red (fee-dominated).

Visually, it’s simple. Conceptually, it’s profound.

A Quick Refresher on Miner Revenue

Miners are paid in two ways:

Block Subsidy - Newly created Bitcoin, fixed by the protocol and halving roughly every 4 years.

Transaction Fees - Fees users pay to have transactions included in blocks.

This ratio isn’t really about miners though. It’s about behaviour:

In Euphoria: Users bid up fees to ensure their transactions are processed. The ratio spikes into the red as the network becomes crowded.

In Exhaustion: Speculation dries up. No one is in a rush. Fees collapse, and miners rely almost entirely on the block subsidy.

Transaction fees aren’t paid because people feel optimistic. They’re paid because people are competing. And that competition only exists when urgency is high — when speculation, leverage, rotation, or genuine usage intensifies. Fees spike when the network becomes crowded, both emotionally and economically.

During bear markets, the opposite dynamic takes hold:

Interest fades

Speculation dries up

On-chain activity slows

Urgency disappears

As a result, transaction fees collapse, and miner revenue becomes almost entirely dependent on the block subsidy.

Historically, Bitcoin bear markets are defined not just by low fee ratios, but by prolonged flatlining at very low levels, typically around 4-5% or lower. The critical signal isn’t that the ratio drops, it’s that it stays suppressed. That persistence tells us demand hasn’t merely paused; it has been exhausted.

At market tops, this metric behaves very differently. It consistently spikes into red territory, not because price is high, but because behaviour becomes frantic. Everyone wants in at the same time. Traders rotate aggressively, long-term holders distribute, short-term holders churn supply, and block space becomes scarce. Fees explode because the network is emotionally overcrowded.

The most recent clear spike occurred during the post-ETF rally to around $70k. That period showed genuine on-chain euphoria, with demand and urgency visibly surging across the network.

But what followed was far more unusual. Throughout the latter half of 2025, Bitcoin’s price pushed to new highs while the ratio remained pinned at rock-bottom levels of just 1-2%. That divergence tells us the rally wasn’t driven by mass speculation or on-chain mania. It was driven by passive, largely custodial flows, which is a price advance without the behavioural footprint that normally accompanies one.

In that sense, this was a rally without substance. And historically, that kind of apathy is far more consistent with a topping process defined by attrition rather than a classic blow-off top. True cycle peaks tend to coincide with emotional excess. This didn’t.

Instead, what we appear to have witnessed is the “slow bleed” scenario we spoke about a few months back rather than a dramatic collapse. Price didn’t roll over because everyone panicked. It stalled because nobody cared enough to sustain demand against persistent long-term holder selling.

That’s uncomfortable to hear, but it’s the honest truth.

Block Subsidy to Transaction Fees Ratio

My Take on Where We Are Now

If I’m being completely honest, this has been one of the most frustrating years for the average crypto native trader. We’ve been stuck in a period I’ve dubbed the "Slow Bleed". In previous cycles, we usually got a massive, terrifying crash that cleared the air and made the top (and bottom) blindingly obvious.

This time, the market chose to bore us to death instead. We’ve seen multiple failed expansions and a total lack of engagement on-chain. It feels like a bear market not because everyone is panicking, but because nobody really cares.

But here is my personal take: this is actually a gift if you have the stomach for it. When the fee ratio is at 1% and the Bull Momentum Gauge is deeply suppressed, the weak hands aren't just out, they've forgotten the password to their exchange accounts. History shows that the best opportunities don't emerge at the moment of peak excitement, but at the moment of peak indifference.

In my opinion, we are most likely past the halfway point of this exhaustion process. Macro conditions still look constructive heading into next year. Liquidity dynamics matter, and structurally, Bitcoin’s long-term case hasn’t changed.

But momentum right now is undeniably negative.

And when you combine a positive macro backdrop with deeply exhausted momentum and participation, you get something interesting: not danger, but patience-testing opportunity.

This doesn’t feel like a market waiting for one final emotional flush. It feels like a market that’s already been quietly grinding people down for longer than most realise.

That kind of bear market doesn’t ring a bell at the bottom. It just stops hurting. The mistake most people make is confusing price with progress. Markets don’t turn because everyone suddenly feels bullish again. They turn because bearish momentum has dried up.

If you can sit through that boring, frustrating, and uneventful process, you put yourself on the right side of the next regime shift, instead of chasing it after the fact.

I’ll catch you in the next one.

Cheers,