A technical framework for trading volatility inside a macro-bearish market

Most of the time, I live comfortably in the world of macro and on-chain data. It’s slow, deliberate, and ruthlessly effective. But every so often, the short-term starts to matter. Not because it changes the long-term thesis, but because it reveals how the market is behaving right now.

This article takes a deliberate step away from my usual macro-heavy framing. Instead, we zoom right in and examine Bitcoin through the lens of short-term positioning, regime awareness, and advanced mean-reversion tools.

The aim is not to predict the future, but to understand the structure of risk and opportunity as it currently exists.

Let’s get into it.

Macro Regimes Still Rule Everything: Short-term trades only work when framed inside the correct macro environment.

Our Line In The Sand Matters: The 100k regime divider isn’t just psychological, it’s structural and dynamic.

Mean Reversion Is Not Bullishness: Extreme downside moves often snap back without changing the broader trend.

The Next Floor Is Closer Than It Looks: We identify the next major structural support zone after the failing of the previous local level.

Start With the Regime, Always

Any good short-term analysis starts in the exact same place as long-term investing: the macro regime.

This is where most traders go wrong. They try to scalp, trade, or position without understanding what type of market they’re in. Trends behave differently in bullish regimes than they do in bearish ones, and mean-reversion works very differently depending on that backdrop.

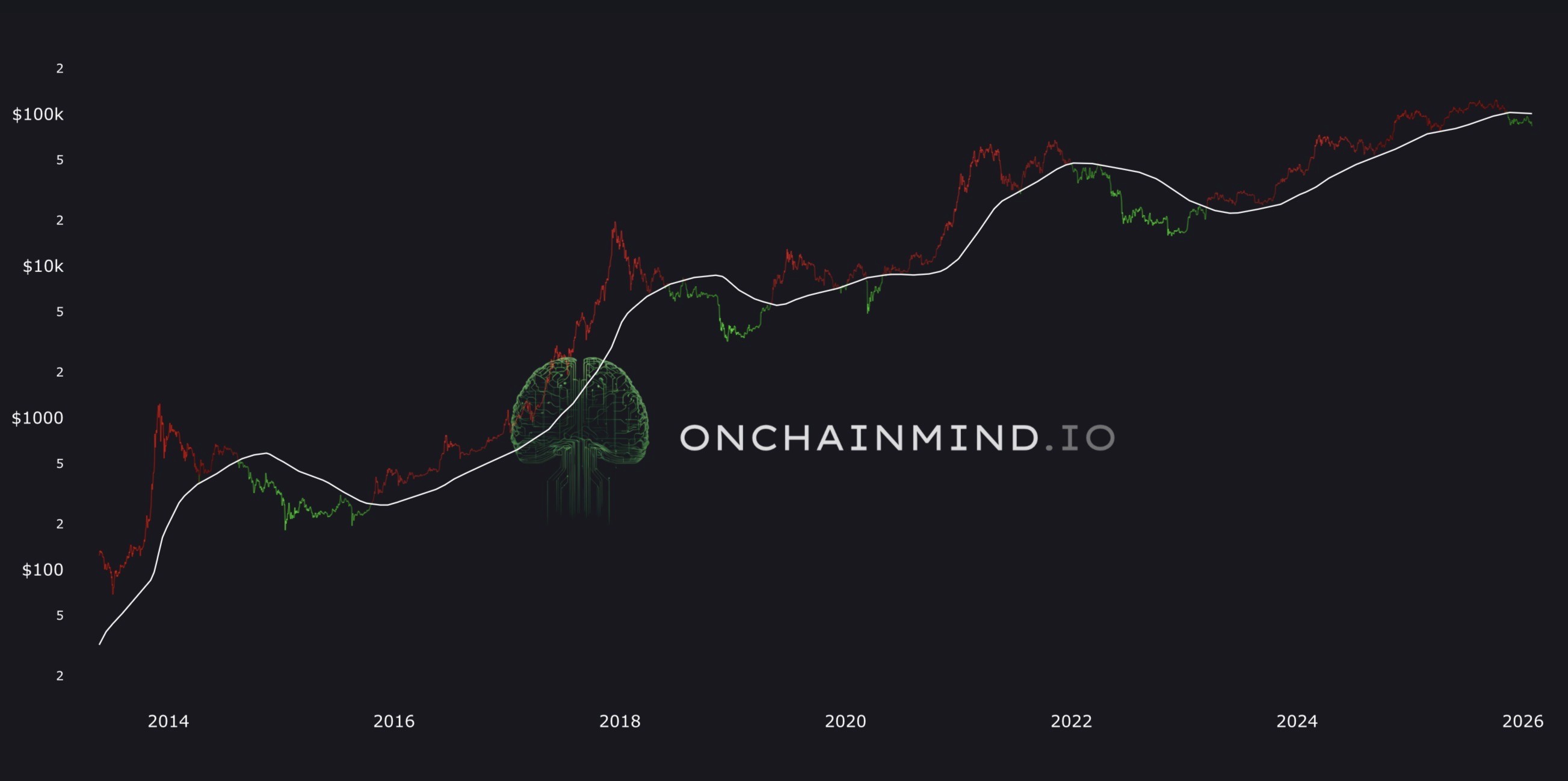

The cleanest way I know to define Bitcoin’s macro regime is the Bitcoin Regime Divider. Now this is simple, but deceptively powerful:

Red indicates a bullish regime

Green indicates a bearish regime

The divider itself is derived from Bitcoin’s yearly moving average, a level that has done a remarkable job of separating bullish and bearish environments throughout Bitcoin’s entire history.

And when I say remarkable, I mean it. There is very little ambiguity on the chart. Bitcoin has spent long, sustained periods either clearly above or clearly below this line (minus the Covid black swan), and those periods align uncannily well with broader market behaviour.

Right now, we are sitting in the 5th bearish regime Bitcoin has ever experienced.

The current dividing line where regime opinion would begin to change sits at $100,000. That’s a level we have talked about a lot recently, and it moves constantly as the yearly average evolves. But at present, any sustained price action below that level should be treated as macro-bearish by default.

That does not mean price cannot rally. It does not mean volatility disappears. It does mean that upside should be treated sceptically, and risk should be managed aggressively.

Until Bitcoin reclaims that regime divider, the market remains lean-bearish. That is the framework within which all short-term positioning should be evaluated.

Bitcoin Regime Divider

Mean Reversion in a Bearish Environment

Once the macro regime is defined, we can safely zoom in.

For short-term trading and scalping, one of the most effective tools available is the Nadaraya-Watson Z-Envelope. This is not a traditional indicator, and it is not a moving average dressed up with fancy language.

It is a refined volatility and mean-reversion model built on non-parametric regression, specifically the Nadaraya-Watson estimator using Gaussian weighting.

In plain terms, it creates:

A dynamically smoothed central price line

Upper and lower adaptive bounds

Envelope behaviour that responds to localised volatility

The result is a structure that highlights statistical overextension with remarkably low lag.

Right now, Bitcoin’s price is touching the lower envelope, which is sitting around $83,000. That is not common.

Price frequently approaches the envelope boundaries, but actual touches or breaches of the upper or lower band are rare. When they occur, it usually indicates that the preceding move was extreme relative to recent volatility. This is classic mean-reversion territory.

The centre of the envelope, currently near $88,000, represents the dynamic mean around which price tends to oscillate. While its calculation is complex, you can think of it loosely as a volatility-aware, adaptive equilibrium level.

However, let’s get it straight: a mean-reversion bounce is not bullish.

In bearish regimes, price often rebounds from the lower envelope towards the centre, and sometimes even towards the upper envelope, while the entire structure continues trending downward.

That is exactly what we’re seeing now. The envelope itself is falling. The upper bound has dropped from roughly $97,000 to $94,000 in just a couple of weeks. That alone should temper expectations.

Bitcoin does not move vertically without significant macro catalysts. Expecting sustained price acceptance above $90,000 in this environment is optimistic at best. Without a major macro shock, it’s simply a tall order.

From a trading perspective, that gives us clarity:

The envelope centre acts as a naturally neutral zone

$90,000-$92,000 becomes a no-brainer short-term profit-taking region

Any move into that area should be treated tactically, not emotionally

This envelope allows us to operate both short and long positions within a downtrend, rather than fighting it or pretending it doesn’t exist.

Bitcoin’s Nadaraya-Watson Z-Envelope

Structural Support and the Importance of the Next Floor

Mean reversion tells us where price wants to go. Structural analysis tells us where it might stop.

Recently, Bitcoin broke through a key local support level around $87,000, and it did so quickly. That speed matters. Fast breaks through established support are typically bearish signals, indicating weak demand and poor absorption.

To understand what comes next, we turn to Price Zone Dynamics.

This is not simple horizontal support and resistance. It’s an algorithmic structural framework designed to map where liquidity has historically accumulated and where price has demonstrated memory.

The system works by:

Identifying pivot highs and lows across a defined lookback

Scoring each level based on retests and proximity

Measuring violation frequency to assess fragility

Visualising significance through line thickness and opacity

The result is a dynamic heatmap of latent support and resistance. According to this framework, the next major structural support sits around $78,000.

If Bitcoin relief rallies off the lower envelope and then rolls over again, this is the zone I would expect price to gravitate towards next. It is the next meaningful area where demand could plausibly step in.

But there’s a darker implication here too.

We really do not want to see $78,000 fail decisively. If it does, structural support thins out rapidly, and the probability of a sharp move into the $60k 2024 consolidation range increases significantly. That would not be pretty.

This is why understanding structure is so important. Support is not just about lines on a chart. It’s about where the market has previously remembered value and whether that memory still holds.

Bitcoin’s Price Zone Dynamics

Where I Personally Stand Right Now

Let’s be straight up. The regime remains bearish until proven otherwise. Even though I believe the macro and liquidity backdrop for 2026 looks constructive, that belief is irrelevant without confirmation. Until the charts say so, I have to respect what they are telling me.

That said, short-term mean-reversion opportunities still exist. But they are tactical, and not thesis-changing. Structural support is thinning, and that commands respect.

Personally, I keep around 20-30% of my capital allocated to trading positions. That might be Bitcoin, Altcoins, or even traditional equities. There are always short-term opportunities available, while the remaining 70-80% of the portfolio quietly dollar-cost-averages, waits patiently, or prepares for what could become a once-in-a-cycle buying opportunity.

I’m not interested in any hero trades here. I’m interested in clarity. For the next few months, these are the rules I’m applying to that trading allocation:

Trim into strength, not weakness

Respect envelope dynamics without mistaking them for trend reversals

Treat rallies as opportunities to manage risk, not chase upside

Stay humble around key structural levels

Be willing to flip bias only when the trend confirms it

Bitcoin doesn’t owe us clean moves or easy trades. It rewards patience and punishes narrative-driven optimism.

If price holds $78,000 and builds acceptance, we reassess. If it doesn’t, capital preservation becomes the priority, and I’ll be watching closely for the kind of opportunity that only appears once per cycle. Either way, the framework does not change.

Short-term tools are powerful, but only when used in the right regime, with the right amount of capital, and with realistic expectations.

Use them wisely, and best of luck.

I’ll catch you in the next one.

Cheers,

Tom, On-Chain Mind

Copyright © 2025 On-Chain Mind