Timing, risk, and returns: which strategy wins in crypto?

When it comes to investing, few debates spark as much passion as the one between dollar cost averaging (DCA) and lump sum investing. Should you drip-feed your capital slowly over time, or throw it all in at once and hope for the best? It’s a decision that can fundamentally shape the trajectory of your portfolio.

In a recent 𝕏 poll I ran, only 16% of you said they use purely flat DCA. That means the vast majority (84%) believe they can beat the market to some extent, whether through timing lump sum investments or a hybrid strategy.

Today, we’re going to break down these approaches, examining the outcomes of buying Bitcoin (and Altcoins) at the highs, the lows, and everything in between. Plus, I’ll run through exactly how I like to play this market.

Let’s get into it.

Timing Matters More Than You Think: Historical data shows lump sum investing tends to outperform DCA, even when entered close to market peaks.

Volatility vs. Returns: DCA smooths your ride, but lump sum can multiply returns dramatically, if you can stomach the swings.

The Peak Paradox: Even buying Altcoin-heavy portfolios at the absolute cycle top offers massive outperformance via lump sum, but demands a legendary iron stomach.

Refining The Strategy: We delve into daily, weekly, or monthly DCA amounts, automation, trading fees and my personal strategy.

Understanding the Two Strategies

Before we dive into the numbers, let’s clarify the two dominant approaches:

Lump Sum Investing: Deploy your full capital at once. High-risk, high-reward. If timed correctly, it can generate extraordinary returns. But mistime it, and you could be underwater for many years.

Dollar Cost Averaging (DCA): Invest a fixed amount at regular intervals, regardless of price. DCA reduces the risk of buying at a euphoric peak and smooths portfolio volatility, but it tends to dilute returns during strong bull markets.

Today, we’re going to primarily assess Bitcoin, but the principles translate easily to other assets such as altcoins, stocks, or mixed portfolios. And if you want to use the tools shown here today, you can check them out here:

The yardsticks we’ll use are:

Portfolio Value in Dollars – the total worth at the end of the period.

BTC Accumulated – how many Bitcoin you’ve actually acquired.

Compound Annual Growth Rate (CAGR) – the annualised return, accounting for the compounding effect.

We always start with $10,000. Lump sum deploys it all at once. DCA drips it over the selected period. So let’s break down the numbers and look at what historical performance has in store for us.

Scenario One: Starting 10 Years Ago

DCA: $210,000 portfolio value, 2.76 BTC, 35% CAGR

Lump Sum: $1.9 million portfolio value, 26 BTC, 69% CAGR

Looking back a full decade, this scenario demonstrates the sheer power of deploying capital early in a major bull market. Lump sum investing here dominates dramatically, capturing nearly the entirety of Bitcoin’s explosive growth from 2016 through to 2026. DCA, while it smooths entries and reduces initial volatility, cannot keep pace with the compounding gains unlocked by deploying capital towards the beginning of a cycle.

This example highlights a critical insight: timing can create enormous asymmetry in outcomes. Over multi-year horizons, even small delays in deploying capital can lead to massive opportunity cost. The difference here isn’t just marginal, it’s a magnitude of nearly 10x in portfolio value. For investors willing and able to stomach volatility, lump sum investing early in a cycle is an almost unmatched strategy.

Lump Sum vs. DCA: Starting 10 Years Ago

Scenario Two: Starting 5 Years Ago

DCA: $18,490, 0.24 BTC, 13% CAGR

Lump Sum: $19,840, 0.26 BTC, 14% CAGR

5 years ago, we were closer to the previous cycle’s bull market peak. Conventional wisdom would suggest that a measured DCA strategy should have an edge here, reducing the risk of deploying all capital at a high point. Surprisingly, lump sum still manages a slight advantage.

This underscores an essential lesson: lump sum advantages are not solely about buying at cycle lows. Instead, they stem from the compounding effect over time. Even when deployed closer to a peak, lump sum allows the investor to capture the early phases of subsequent upward swings more efficiently. DCA reduces volatility, yes, but it also leaves a portion of capital on the sidelines during periods of rapid growth, costing you in the long run.

Lump Sum vs. DCA: Starting 5 Years Ago

Scenario Three: Buying The Top

DCA: $49,657, 0.65 BTC, 21% CAGR

Lump Sum: $38,683, 0.50 BTC, 18% CAGR

This simulation sees us deploying our capital at the absolute peak day of the 2017 bull market. This is where intuition and emotion often collide with reality. Most investors would assume that buying at the absolute peak would devastate a lump sum strategy, making DCA the obvious safer choice. Yet the difference here is surprisingly modest. DCA does outperform slightly, primarily because it spreads exposure over the peak, avoiding a single catastrophic entry.

Even at the top, lump sum investing remains viable. The gap is noticeable, but not catastrophic. This scenario illustrates the critical point that long-term holding can significantly offset mistimed entries. In a highly volatile asset like Bitcoin, short-term pain from a peak purchase can be mitigated through patience and conviction. DCA is the smoother path, but it also leaves upside partially untapped during the immediate rebound.

Lump Sum vs. DCA: Buying The 2017 Top

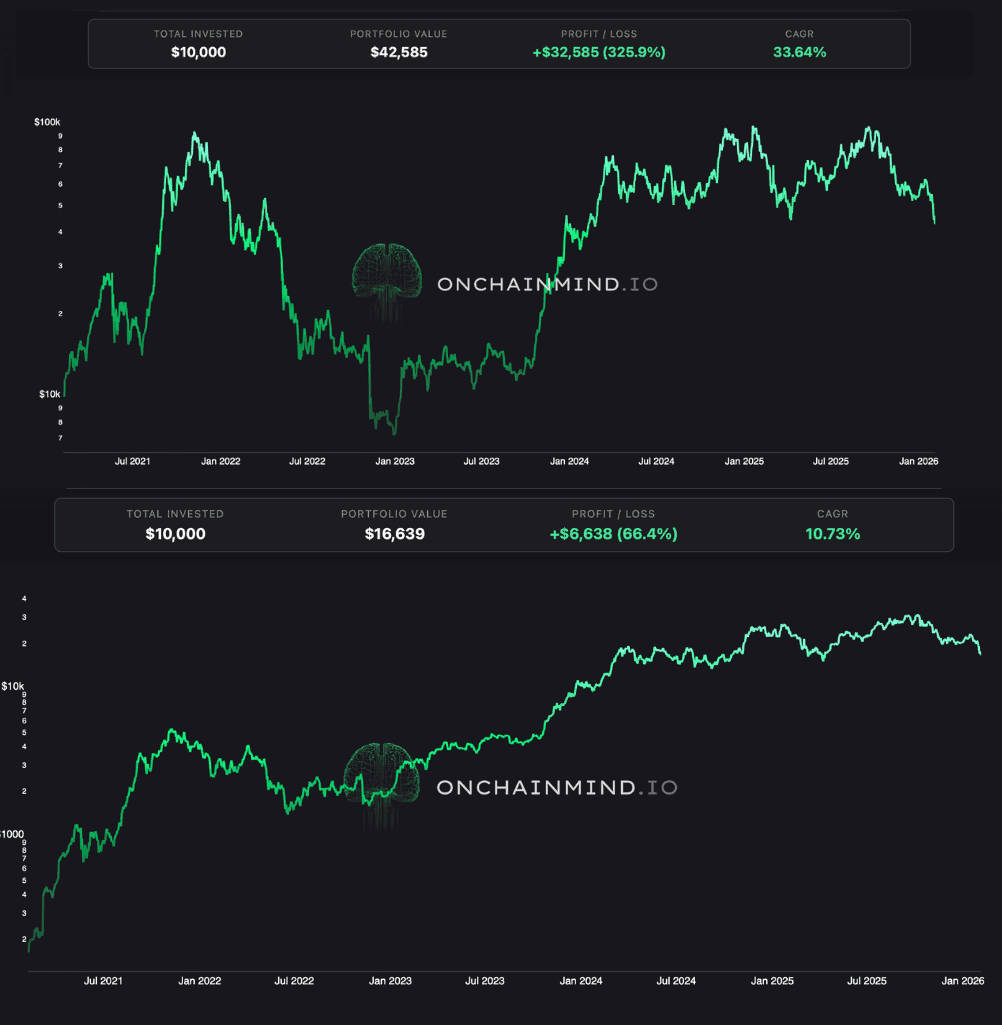

Scenario Four: Mixed Crypto Portfolio Starting 5 Years Ago

DCA: $16,639, 10% CAGR

Lump Sum: $42,585, 33% CAGR

For this final simulation, we’re going to look at a mixed portfolio of BTC 50%, ETH 30%, SOL 20% as an example. What we can clearly see here is adding diversification amplifies both opportunity and risk. In this scenario, lump sum clearly outperforms DCA, producing approximately 2.5x the portfolio value. But the swings for the lump sum approach are brutal: a peak portfolio value of $93,000 plummeting to $7,000 at the low is not to be taken lightly. The volatility here is a real psychological test that many investors inevitably fail at.

DCA, by contrast, produces a much smoother journey, and we can see that visually on the chart. It reduces the emotional and behavioural strain of large drawdowns, steadily accumulating assets without forcing you to watch a single portfolio value swing wildly.

This scenario perfectly illustrates the trade-off: lump sum maximises returns, DCA maximises comfort and reduces behavioural risk.

Lump Sum vs. DCA: Mixed Crypto Portfolio Starting 5 Years Ago

Fees, Frequencies, and Friction

Does it really matter whether you DCA daily, weekly, or monthly? And what strategy do I personally use? Let's explore that.

When it comes to daily, weekly, or monthly DCA frequencies, the data suggests: it really doesn't matter. I ran the numbers for all 3 DCA frequencies across every scenario. And the difference is almost entirely negligible. Whether you buy every morning or once a month, your final BTC balance usually ends up within a fraction of a percent of each other.

So if frequency doesn't matter for the return, what should you focus on? Two things:

Fees

Automation

If your exchange charges a flat fee per trade (e.g. $1.99 per transaction), a daily DCA will bleed your portfolio dry through death by a thousand cuts. In that instance, a monthly buy is mathematically superior. However, if you use a platform with percentage-based fees, the frequency becomes almost irrelevant to your bottom line.

The more critical factor is the mental load. Manually buying Bitcoin every single day requires a level of discipline that eventually feels like a second job. It forces you to look at the price daily, which increases the temptation to "wait for a dip" or skip a day when the news looks grim.

This is where the strategy breaks.

Unless you can automate the process through a script or a dedicated service through your exchange, daily DCA is often a recipe for burnout. Weekly or monthly intervals provide a much healthier balance for the manual investor.

But for those of you who can automate low-fee daily DCA, the benefit is mostly psychological, meaning you get to see your Sats accumulating every day. Otherwise, a longer timeframe DCA schedule is more sensible.

The subtle lesson here: the mechanics of DCA matter less than the execution. Keeping costs low and automation smooth is far more important than obsessing over the precise interval.

The Hybrid Path to Sanity

It turns out that the 84% of you who want to "beat the market" are onto something. The data is clear: if you have a long-term horizon (5+ years), lump sum investing is historically the superior wealth generator. However, we don't live in a spreadsheet; we live in a world of emotions, mortgage payments, and global uncertainty.

Here’s how I play it.

Personally, I lean heavily into a hybrid approach. While my tools and data models give me the confidence to deploy larger lumps of capital when the market is objectively undervalued, I am humble enough to admit that I won't be right 100% of the time.

Remember: the market can always stay irrational longer than you can stay solvent.

Because of this, I maintain a small, automated DCA at all times. This baseline investment ensures that I am always accumulating, even when I'm hesitating on a larger entry. It keeps me tethered to the market's growth without the stress of trying to catch every single bottom. It’s not a huge amount. It’s enough for me not to really notice it leaving my account, but substantial enough that it will make a measurable difference to my net worth in 10-20 years time.

The hybrid approach is not perfect. It won’t always beat pure lump sum, but it balances risk, reward, and the human element of investing. In a market as volatile as Bitcoin/crypto, this combination often makes the difference between staying invested and panicking out.

And don’t get me wrong, I’m certainly not a hater on a straight DCA approach. It’s very easy to underestimate the psychological dimension. Investors often sell out of fear when their portfolios plunge or hesitate to deploy capital at key moments due to anxiety about timing.

This is particularly relevant right now. I’m getting so many messages about people being afraid to deploy into this market because of fears of it going lower. Yet, they were perfectly happy buyers when Bitcoin was trading well above $100,000. It's fascinating to see this psychology playing out in my own community.

DCA naturally mitigates all of this risk. It forces discipline and patience, while lump sum requires conviction. To hold through a 70%+ portfolio drawdown demands a very different mindset.

The main lesson here is that the sting of a lump sum only happens when you pour all your capital into a euphoric, overextended market peak. And there are many metrics here at On-Chain Mind that will help you avoid falling into that trap. But even then, as we saw with the 2017 top buyer, time is the great equaliser.

The key takeaway from this piece is: if you are investing for the next decade, the "when" matters far less than the "if”.

The only true way to lose in this game is to be uninvested or to be shaken out by volatility that you weren't prepared to handle. Choose the strategy that allows you to stay in the game the longest, because in the world of Bitcoin, survival is the ultimate multiplier.

I’ll catch you in the next one.

Cheers,

Tom, On-Chain Mind

Copyright © 2025 On-Chain Mind