•

Why long-term holders are going to decide Bitcoin’s next major move

When the "smart money" starts moving, the rest of the market tends to hold its breath.

In the final quarter of 2025, we witnessed a tectonic shift in Bitcoin’s ownership structure that redefined the conclusion of the year. Long-term holders (LTHs) embarked on a distribution spree that tested the resolve of every Bitcoin market participant. But as we transition into 2026, the tide is beginning to shift.

In this Premium market update, I break down why long-term holder behaviour effectively closed the chapter on Q4 2025, why their recent distribution overwhelmed even strong ETF demand, and what the profit levels among LTHs tell us about potential bottoms, or extended corrections.

Let’s get into it.

Q4’s Big Move: We explore why long-term holder distribution became the dominant force shaping the year’s close.

A Subtle but Crucial Shift Emerges: Early on-chain signals suggest the selling pressure may be easing in a meaningful way.

Beyond the Short-Term Flip: We decode what the longer-term view of holder behaviour reveals about potential cycle turning points.

Profit Dynamics and Incentives: The changing unrealised gains among veteran holders influences future supply pressure and marks textbook accumulation opportunities.

The Q4 Tug-of-War

The closing months of 2025 were defined by a single narrative: the aggressive distribution of Bitcoin by long-term holders.

In the world of on-chain analytics, we define a long-term holder as any wallet holding coins that last moved > 155 days ago. Statistically, once a coin crosses this threshold, the likelihood of it being spent drops dramatically. These are the investors who typically buy in the depths of the bear market and sell into the euphoria of the bull.

When this cohort starts selling in bunches, it usually marks local or even cycle-defining peaks. They’re commonly referred to as the "smart money" because they typically realise profits and transfer their coins to short-term holders (or the "dumb money" in this scenario) at the top.

While some analysts argued that LTHs were simply rebalancing for safety moving their physical coins into the new spot ETFs, this theory doesn't hold water under closer inspection. The ETF inflows, while substantial, did not match the LTH outflows by a long shot.

This was a genuine exit of supply. Despite the consistent, relentless bid from spot ETFs and corporate treasuries, the sheer volume of LTH selling simply could not be outlasted, leading to the price volatility we’ve recently endured.

This is a critical lesson here: price doesn’t normally top because demand disappears. It tops because supply overwhelms it.

From Distribution to Potential Accumulation

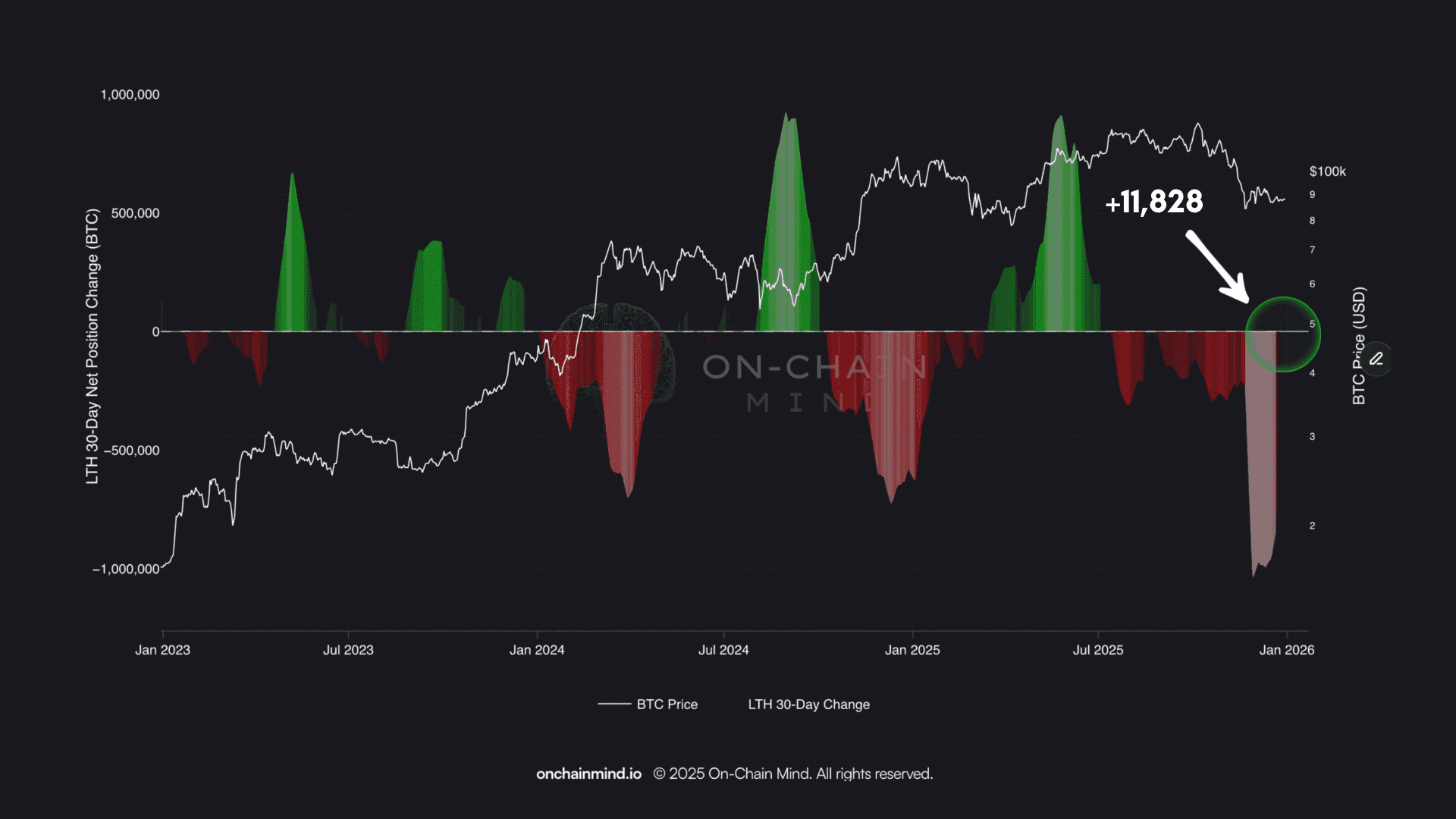

One of the cleanest ways to track long-term holder behaviour is through the 30-Day Net Position Change, which has been increasingly circulating Crypto Twitter recently. This metric measures the net change in Bitcoin supply held by long-term holders over a rolling 30-day window.

Here’s how it works:

Green values (positive):

More coins are maturing from short-term holders into long-term holders than are being spent, or

Existing long-term holders are actively accumulating while maintaining an average coin age > 155 days.

Red values (negative):

Long-term holders are spending or selling coins faster than new coins are maturing or being added into the cohort.

Across this entire cycle, this indicator has been remarkably accurate at identifying both local price peaks and local troughs. It’s not flashy. It doesn’t predict tops in advance. But it has confirmed them with brutal honesty.

What’s interesting now is that the metric has just flipped back into green, albeit marginally. The current reading sits at +11,828 BTC over 30 days. On its own, that number looks insignificant. In context, it rarely is.

In previous cycles, even a modest turn back into positive territory has often aligned with early bottom formation. This doesn’t mean price must immediately reverse. But it does mean downside momentum is losing one of its most powerful drivers.

LTH 30-Day Net Position Change

Year-on-Year Distribution Tells a Bigger Story

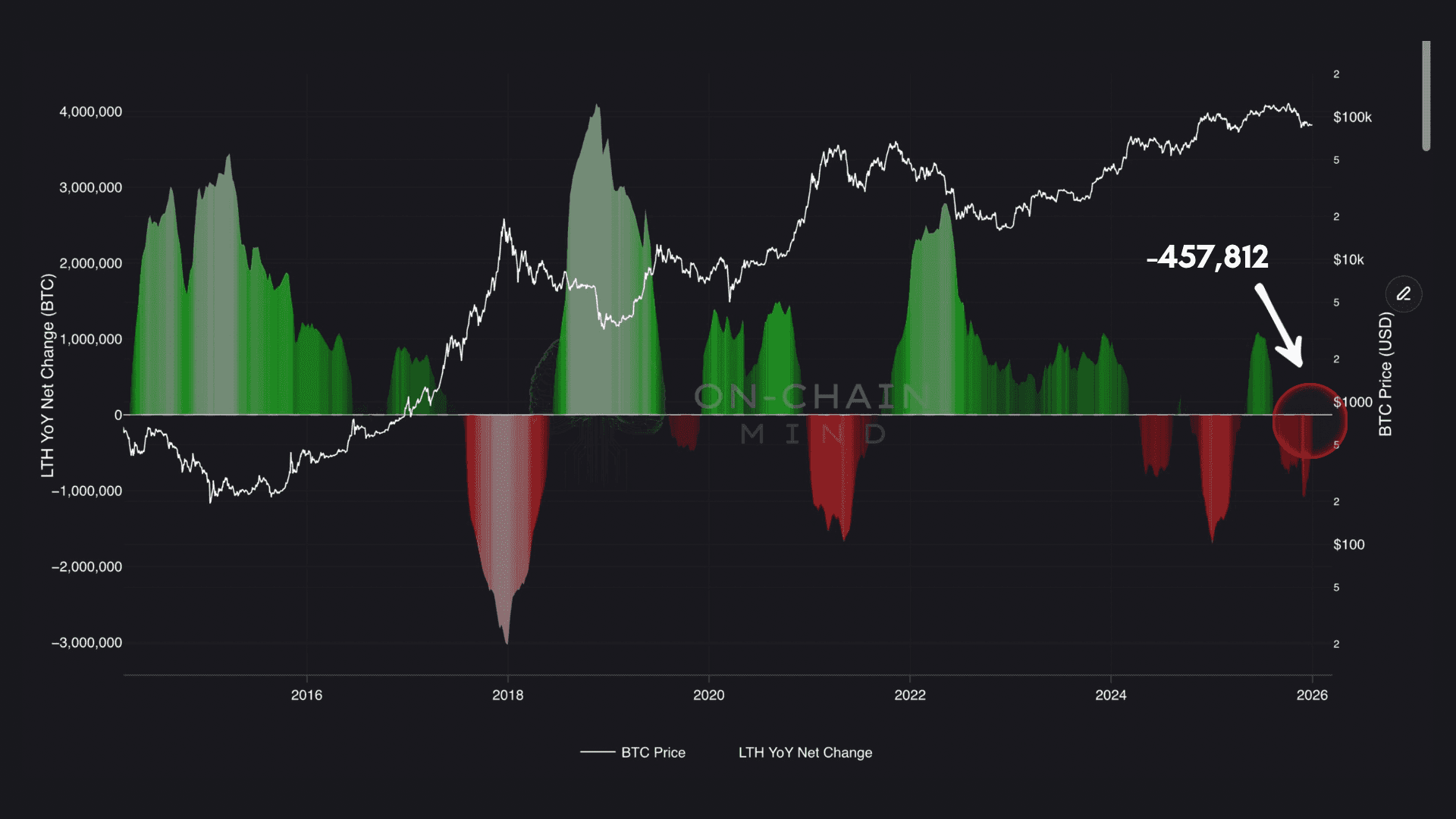

While the 30-Day Net Position Change is great for identifying local price peaks and toughs, to truly understand where we sit in the cycle, we need to step back and look at the Year-on-Year Net Position Change. This view smooths out short-term noise and highlights cycle-defining accumulation and distribution phases.

What stands out immediately is that we’ve now seen 3 major long-term holder selling events this cycle:

The ETF-driven rally near $70,000.

The psychological break above $100,000.

The most recent distribution phase.

But the third event is the most important. And the most misunderstood.

Unlike prior red zones, this was the largest distribution event that occurred while price was already declining. Historically, heavy long-term holder selling tends to mark strength, not weakness. This time really was different.

At present, the year-over-year reading still sits firmly negative at around -457,000 BTC. That means that the long-term holder balance, in aggregate, is less than what it was compared to a year ago.

Directionally, it’s improving, trending back upwards toward zero. But we’ll need it to cross into positive territory for stronger confirmation of a macro bottom. Until then, caution is definitely warranted. This could still evolve into consolidation rather than an immediate reversal.

This is not an exact timing tool. It’s a confirmation tool. And it’s one to watch closely.

Year-on-Year Net Position Change

Profit Is the Real Incentive

Long-term holders don’t sell indiscriminately. They’re profit-driven like anyone else, and they sell because their profit thresholds have been met.

That’s where the LTH % Supply in Profit metric becomes invaluable. It measures what percentage of the long-term holder cohort is sitting on unrealised profit at current prices.

When this metric reaches 100%, local and/or cyclical peaks have historically followed. It means virtually every seasoned holder is in profit, and the incentive to realise gains becomes overwhelming.

Since early 2024, this metric hovered stubbornly near 100%, with only a brief dip during the summer correction following the ETF euphoria. That persistent profitability explains why distribution remained so heavy for so long.

But what’s changed recently is far more important.

We’ve just seen the largest decline in long-term holder profitability of the entire cycle, with only 82% of the cohort now in profit. And structurally, it matters.

As price falls:

Fewer long-term holders remain incentivised to sell.

Distribution pressure naturally weakens.

Supply becomes stickier at lower levels.

Historically, every bear market bottom in Bitcoin’s history has formed when this metric drops to around 50% — meaning half of long-term holders are in profit, and half are underwater. This creates a state of total market exhaustion.

If you are a bear and believe we are entering a long 2026 winter, then mathematically, there may still be room for this metric to fall another 30% along with price. But if you believe macro conditions are improving into 2026 (liquidity, rates, and risk appetite included) then this drop to the 82% zone begins to look less like danger and more like a significant cooling off of sell-side pressure and a primary long-term accumulation opportunity.

LTH % Supply in Profit

The Resilience of the 155-Day Wall

Watching the LTHs sell into a declining price in late 2025 was, frankly, a bit of a shock to the system. It defied the traditional smart money playbook of selling only when the tourist investors are FOMOing in.

To me, this suggests a massive shakeout of older participants who perhaps didn't believe in the $100k+ sustainability or were spooked by the ever-changing macro environment.

But here is my honest opinion: the fact that the 30-Day Net Position Change has flipped green already is incredibly bullish. It tells me that the new long-term holders are now the ones holding the line. We are seeing a generational handoff. The "OG" coins from early in Bitcoin’s history have likely finished their major distribution, and the new "Institutional LTHs" are stepping in.

I don't think we need to see 50% of holders in a loss to find a bottom this time. The market has matured. The presence of the ETF bid creates a higher floor for pain. If you’re waiting for $30,000 to buy back in because the charts say we need 50% LTH profit, you might just miss the boat entirely.

Personally, I don’t need perfection. I want alignment. And right now, behaviour is starting to align with early-stage accumulation, not late-stage distribution. I'm looking at this 82% level as a decent level. We’ve certainly flushed out a lot of weak hands and the over-leveraged, and the coins are moving back into the hands of those who have the patience to wait for the next high in Bitcoin’s journey.

I personally don’t believe 2026 is a year for fear. For me, it's a year for calculated positioning.

Long-term holders have told the story of every Bitcoin cycle from the very beginning. And they may be quietly writing the opening chapter of the next one.

I’ll catch you in the next one.

Cheers,